GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

Fort Worth, Texas October 18, 2018 – Oracle Oil and Gas LLC (Oracle Oil and Gas) a wholly owned subsidiary of Oracle Energy Corp. (“Oracle”) (TSX.V: OEC) (Frankfurt: O2E) announces that it has engaged Blade Energy Partners of Dallas and Houston to provide design work for their planned Eagle Ford wells.

Blade Energy Partners is an independent technical petroleum consultancy firm with deep experience in geophysics, petrophysics, geology, reservoir engineering, reservoir simulation, drilling, completions and production. Blade has significant experience in the Eagle Ford having worked on projects in the play for public and private operators. The scope of work Blade is performing for Oracle Oil and Gas includes reservoir modeling, spacing evaluation, frac design and well design.

Blade has been working on the Oracle Eagle Ford project since early July 2018 and a final report is expected this month. This work will maximize the opportunity for early success and maximum recovery.

Chairman and CEO, Darrell McKenna commented “I have known the people of Blade for much of my career and I am very comfortable that we are getting the best Eagle Ford engineering work available. We will have the design work necessary to drill, complete and produce successful wells and we look forward to spudding Oracle’s first Eagle Ford well in the first quarter of 2019.”

ON BEHALF OF THE BOARD OF DIRECTORS.

Darrell McKenna; Chairman and CEO

About Oracle Energy Corp.

Oracle Energy Corp. (TSX.V: OEC) (Frankfurt: O2E) is an oil and gas development company focused on acquiring development assets in North America and with a current focus in the Texas Eagle Ford.

For further information, please contact:

Darrell L McKenna Nasim Tyab

Chairman & CEO Founder & Capital Markets Strategist

Mobile: 1-832-212-1930 Mobile: 778-373-6911

Email: dmckenna@oracleenergy.com nasim@oracleenergy.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Forward-looking statements in this release are made pursuant to the ‘safe harbour’ provisions of the Private Securities Litigation Reform act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties.

Source: Oracle Oil and Gas LLC

FORT WORTH, TX, Sept. 10, 2018 /CNW/ – Oracle Oil and Gas LLC (Oracle Oil and Gas) a wholly owned subsidiary of Oracle Energy Corp. (“Oracle” or the “Company “) (TSX.V: OEC) (Frankfurt: O2E) is pleased to announce that Reese R Mitchell has joined the company and will assume the position of Sr. Vice President Operations. Mr. Mitchell will be responsible for engineering, drilling and operations.

Mr. Mitchell has 37 years of operational, technical, and management experience in the U.S. and International onshore and offshore. Has held senior leadership roles overseeing unconventional drilling, completion, production & associated disciplines. From 2012 through 2017 he served as the Senior VP of Operations for Vitruvian II, a large private equity backed SCOOP mid-con operator. In this position he managed all aspects of drilling and completion activities including running 4 rigs for a three-year period, drilling 48 horizontal wells and growing production to over 30,000 boe/d. Mr. Mitchell earned a Bachelor of Science degree in Natural Gas Engineering from Texas A&I University.

Art Green, formerly Production Manager will assume the role of Sr. Advisor. Mr. Mitchell and Mr. Green will report to Darrell McKenna – Chairman and CEO.

Chairman and CEO, Darrell McKenna commented, “Oracle has embarked on an aggressive Eagle Ford growth plan; has already made a down payment and an option payment on a total of 6,310 acres and has completed a NI 51-101 compliant report. Oracle anticipates spudding the first well this year. Reese is a very important addition to Oracle’s leadership team. His capabilities and experience will be invaluable as we approach the drilling and operations phase of Oracle’s Eagle Ford project. We are familiar with his background and reputation and welcome the technical expertise and leadership he brings to his functions.”

ON BEHALF OF THE BOARD OF DIRECTORS.

Darrell McKenna; Chairman and CEO

About Oracle Energy Corp.

Oracle Energy Corp. (TSX.V: OEC) (Frankfurt: O2E) is a junior oil and gas development company focused on acquiring development assets in North America and with current focus in the Texas Eagle Ford.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Forward-looking statements in this release are made pursuant to the ‘safe harbour’ provisions of the Private Securities Litigation Reform act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties.

SOURCE Oracle Oil and Gas LLC

FORT WORTH, TX, Aug. 27, 2018 /CNW/ – Oracle Oil and Gas LLC (Oracle Oil and Gas), a wholly owned subsidiary of Oracle Energy Corp. (“Oracle” or the “Company “) (TSX.V: OEC) (Frankfurt: O2E), is pleased to provide an update on the acquisition of Texas Eagle Ford assets described in the June 19 news release.

The Assets

Oracle has completed initial payments, each for US$500,000, on 2 assets in the Eagle Ford.

The first asset is the subject of a Purchase and Sale Agreement dated June 7, 2018 with an arm’s length private limited liability company qualified to do business in Texas whereby Oracle is to acquire specific infrastructure and oil and gas mineral acreage which are held by production (the “HBP Assets”), located in South Texas. The productive formations which are present throughout the area are the Buda (the deepest), the Eagle Ford (upper and lower) and the Austin Chalk (the shallowest). The HBP Assets include 2547 net acres of mineral lease rights, of which 613 acres are to the base of the Buda, 640 acres are to the base of the Eagle Ford and 1294 acres are to the base of the Austin Chalk. The HBP Assets also include; 7 producing wells, 6 shut in wells, a water disposal well and the production infrastructure situated on the properties. The July production from the HBP Assets was 1273 barrels of oil and 5020 thousand cubic feet of gas. There is opportunity with the existing wells for workovers to significantly increase production. Pursuant to the terms of the Purchase Agreement the Company will acquire a 100% working interest and a 74% net revenue interest. The total consideration to be paid by the Company for the Assets is US$5,000,000 (the “Purchase Price”) payable by September 28, 2018 (the “Closing Date”) subject the payment of a 10% down payment (US$500,000) by July 1, 2018, which was completed on June 28.

The second asset is the subject of an Option Agreement, dated May 19, 2018, with four arm’s length private entities doing business in Texas (collectively the “Optionors”) which own acreage adjoining the HBP Assets (the Adjoining Lands). This Option Agreement will result a total (including the HBP acreage) of 6310 net acres of which 4923 acres are for all depths, 613 acres are to the base of the Buda, 640 acres are to the base of the Eagle Ford and 134 acres to the base of the Austin Chalk. In accordance with this agreement, Oracle has paid the option payment of US$500,000 and is required to sign an Oil and Gas Lease and a Surface Lease and to pay the balance for the leases by September 28, 2018. This full consideration will earn; a working interest of 100%, a 3 year right to drill, an option to extend the lease for another 2 years and the subsequent right to retain the productive acreage by payment of a 25% royalty on production. The lease includes a requirement to drill 2 wells in the first year of the lease.

Oracle is focused on exploiting the Lower Eagle Ford, in addition it is aware of the production potential in this acreage in the Buda and the Austin Chalk formations.

In addition to the 2 Agreements described above and as reported in the June 19 press release, Oracle has also entered into an agreement, dated May 1, 2018, with a private Texas entity in respect to obtaining oil and gas rights relating to “Additional Lands” which are adjoining the HBP Assets and the Adjoining Lands.

The NI 51-101 Report

Oracle commissioned RPS Energy Limited (RPS) an independent qualified evaluator, to prepare a report of the oil and gas recovery potential from the Lower Eagle Ford in the proposed acreage. Based on the results of the evaluation conducted by RPS, with an effective date of May 1, 2018, Oracle expects commercially recoverable volumes of 31 million barrels of oil and 59 billion cubic feet of gas from the Lower Eagle Ford formation in the lease area. These volumes are currently classified as 2C Contingent Resources in the Development Pending sub-class. The 2C classification indicates there is a 50% probability the recovered volumes will exceed these estimates and a 50% probability that the recovered volumes will be less that these estimates. The un-risked, after tax, net present value, discounted at 10%, for these assets is $329 MM US. The project development, based on a conceptual development plan, would begin with drilling commencing in early 2019 and completing in early 2023. First production would occur the first half of 2019. The development plan calls for 50 horizontal, long lateral, wells and a development cost of $358 MM US. There is uncertainty that it will be commercially viable to produce any portion of the resources.

With respect to the recoverable resources evaluated in the RPS report, Oracle notes that the specific contingencies which prevent the classification of the resources as reserves are related to obtaining the necessary financing to develop the resource; and that the technical risks associated with the recovery of the resources are minimal, as there are existing producing analog wells surrounding and within the lease area. The significant positive factors relevant to the estimate are the potential to bring undrilled lands, with proven production potential in the subject producing formation, on production within a very short time frame by application of modern horizontal well drilling and completion practices. The significant negative factors relevant to the estimate relate to the recovery technology being primary recovery by fluid expansion drive and the potential variability in long term production rates due to unpredictable variations in oil shale quality within the license area.

Funding

The forecast spending on the HBP assets and the Adjoining Lands for the first 6 months is $18.7 million US of which $10.3 million US is for land acquisition and A&G with the remaining $8.4 million for the drilling of an Eagle Ford long lateral horizontal well.

Oracle’s funding plan for developing this program includes an equity raise in Canada for the land acquisition and a structured debt raise in the US for drilling funds. Oracle is discussing the Canadian equity raise with several Canadian institutions and expects to appoint a lead banker in August. Oracle has also retained Petrie Partners Securities, LLC (with its affiliate, Petrie Partners, LLC, “Petrie”), a preeminent boutique investment banking firm to the oil and gas industry, to assist in raising development capital for the drilling portion of the Eagle Ford Development Project.

Resumption of Trading

The Company expects that its shares will resume trading on the TSX Venture Exchange within the next few days.

Chairman Comments

Chairman and CEO, Darrell McKenna commented, “Oracle’s contingent resource evaluation is a critical step in planning for the exploitation of and making the case for our Eagle Ford assets. The report supports and bolsters the magnitude and scale of Oracle’s opportunity. Furthermore, the report verifies our views of ultimate recoveries and confirms the economics. We are confident that we are in the right basin – the Eagle Ford – and are taking the necessary steps to bring value to our stakeholders. Oracle is bullish on the Eagle Ford and intends to continue growing a position in this resource play. We believe the application of ‘cutting edge’ technology to drilling, completing and operating the Eagle Ford will provide superior returns to our shareholders. We are excited about the partnership with Petrie and view them as the ideal advisor to help secure funds for Oracle’s long-term strategic plan to execute on its exciting Eagle Ford drilling opportunity.”

The acquisition of the acreage HBP Acreage, the Additional Lands and the Adjoining Lands is subject to the receipt of approval from the TSX Venture Exchange.

About Petrie

Petrie is a boutique investment banking firm offering financial advisory services to the oil and gas industry. Petrie provides specialized advice on mergers, divestitures and acquisitions and private placements.

The firm was formed in 2011 by senior bankers formerly with Bank of America Merrill Lynch and Petrie Parkman & Co., an investment bank that built a reputation as a trusted advisor to energy clients during the nearly two decades leading up to its merger into Merrill Lynch in 2006. Through tenure with Petrie Parkman, Merrill Lynch and Bank of America Merrill Lynch, the senior members of the Petrie team bring to bear an average of more than 25 years of energy investment banking experience, including over 300 energy M&A and capital raising transactions representing over $350 billion of aggregate consideration.

ON BEHALF OF THE BOARD OF DIRECTORS.

Darrell McKenna; Chairman and CEO

About Oracle Energy Corp.

Oracle Energy Corp.(TSX.V: OEC) (Frankfurt: O2E) is a junior oil and gas development company focused on acquiring development assets in North America and with current focus on the Texas Eagle Ford.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Forward-looking statements in this release are made pursuant to the ‘safe harbour’ provisions of the Private Securities Litigation Reform act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties.

SOURCE Oracle Energy Corp.

Sign Up for FREE

Stock Alerts from

to be the first to know when this emerging company issues Breaking News!

Oracle Energy Corp is an independent oil and gas company focused on domestic, oil rich unconventional resource plays, located in the oil window in South Texas. Oracle’s business objective is delivering long term sustainable shareholder value through the acquisition, development and exploitation of oil and gas production and reserves.

Oracle Energy Corp is an independent oil and gas company focused on domestic, oil rich unconventional resource plays, located in the oil window in South Texas. Oracle’s business objective is delivering long term sustainable shareholder value through the acquisition, development and exploitation of oil and gas production and reserves.

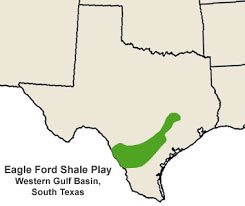

Oracle is acquiring acreage in the Eagle Ford oil window in Texas which is one of the most significant oil-rich resource plays in the continental U.S.

Oracle’s experienced management and operational team will apply “cutting edge” technology to drilling, completion and operations to maximize economic return to shareholders.

Oracle is acquiring acreage in the Eagle Ford oil window in Texas which is one of the most significant oil-rich resource plays in the continental U.S.

Oracle’s experienced management and operational team will apply “cutting edge” technology to drilling, completion and operations to maximize economic return to shareholders.

Based in Vancouver, British Columbia, with operational headquarters in Fort Worth, Oracle trades publicly on the TSX-Venture (TSX-V: OEC)

STRATEGY

Oracle Energy’s business objective is to drive long-term shareholder value through the growth of production, cash flow and reserves. The Company’s strategy is implemented through the following key elements;

- ECONOMIC GROWTH IN THE TEXAS

- Growth opportunity through the acquisition and development of overlooked and undervalued assets in an area de-risked by major oil and gas companies.

- Oracle has deep-rooted relationships in Texas and the Continental US and has first-mover opportunity to acquire the assets

- A COMMITMENT TO THE ECONOMIC APPLICATION OF CUTTING EDGE TECHNOLOGY

- Oracle’s management team are practitioners of technology for economic returns. They have built successful careers leading technical and operational teams in conceiving, designing, implementing and operating successful, high profile projects.

- ORGANIZATIONAL FOCUS AND COST EFFICIENCIES TO REALIZE RETURNS

- Oracle’s management personnel have career long experience in P&L management. They understand the leverage that is possible through the melding of technology and cost effectiveness. They are effective leaders who have implemented organizational cultures and have been very successful in maintaining team focus on company objectives.

- WORK SYNERGISTICALLY WITH FUNDING PARTNERS TO MAINTAIN FINANCIAL LIQUIDITY AND FLEXIBILITY

OPERATIONS OVERVIEW

Oracle Energy’s operations are concentrated in the oil window in South Texas.

Oracle Energy’s operations are concentrated in the oil window in South Texas.

Oracle will employ best practice drilling and completion practices to yield EURs exceeding 700,000 barrels of oil per well

Chesapeake Energy is the major long lateral operator in the area.

As operator and 100% interest owner, Oracle Energy controls the well success factors including:

- Lateral orientation

- “Toe up” hole

- Volume of proppant per foot

- Lateral perforated length

MANAGEMENT TEAM

Oracle’s management team have successful track records based on leadership skills, technical expertise, and business and financing acumen. Oracle people’s technical expertise includes; geoscience, reservoir engineering, facilities engineering, drilling and completions and operation best practices.

The management team has an average experience level of over 35 years, including overseeing operations in unconventional horizontal drilling plays with broad experience in the United States and specifically Texas.

Darrell McKenna is the Chief Executive Officer of Oracle Energy and Chairman of the Board of Directors. He is a seasoned oil and gas executive with over 38 years of experience in the oil and gas industry working in various engineering and leadership roles. Mr. McKenna joined Oracle in 2014, and through his deep-rooted relationships in Texas Mr. McKenna was instrumental in acquiring Oracle’s position and has been instrumental in laying out the development plan and technical strategy for Oracle’s project.

Darrell McKenna is the Chief Executive Officer of Oracle Energy and Chairman of the Board of Directors. He is a seasoned oil and gas executive with over 38 years of experience in the oil and gas industry working in various engineering and leadership roles. Mr. McKenna joined Oracle in 2014, and through his deep-rooted relationships in Texas Mr. McKenna was instrumental in acquiring Oracle’s position and has been instrumental in laying out the development plan and technical strategy for Oracle’s project.

Prior to joining Oracle Energy, Mr. McKenna held a number of senior leadership posts at Hess; Exploration & Production, President of Hess Australia where he was responsible for Exploration and Development of all assets in Australia. Mr. McKenna managed worldwide engineering drilling & completion operations as VP at Hess and Mobil. Mr. McKenna worked with Lewis Energy in San Antonio in a leadership role where he was charged with mapping the forward development plan for Lewis Energy’s South Texas operation.

Mr. McKenna has extensive experience in production, field development and redevelopment, production enhancement and optimization in both onshore and offshore assets and has led technology organizations multiple times, and managed the Global drilling organization, including the Bakken resource play drilling team.

Mr. McKenna’s major projects are Ubit redevelopment, Arun, Ceiba and the Okume Complex, Equatorial Guinea, and most recently the Jubilee and TEN projects in Ghana with Kosmos.

Mr. McKenna holds a degree in Petroleum Engineering degree (with honors) from the Montana School of Mineral Science and Technology (Montana Tech) in Butte, Montana. He is a hands on technical advocate that sets a pace for application of technology to create value for shareholders.

Reese R Mitchell is responsible for engineering, drilling and operations. Mr. Mitchell has 37 years of operational, technical, and management experience in the US and International onshore and offshore. He has held senior leadership roles overseeing unconventional drilling, completion, production & associated disciplines. From 2012 thru 2017 he served as the Senior VP of Operations for Vitruvian II, a large private equity backed SCOOP mid-con operator. In this position Mr. Mitchell, managed all aspects of drilling and completion activities including running 4 rigs for a three-year period, drilling 48 horizontal wells and growing production to over 30,000 barrels per day.

Reese R Mitchell is responsible for engineering, drilling and operations. Mr. Mitchell has 37 years of operational, technical, and management experience in the US and International onshore and offshore. He has held senior leadership roles overseeing unconventional drilling, completion, production & associated disciplines. From 2012 thru 2017 he served as the Senior VP of Operations for Vitruvian II, a large private equity backed SCOOP mid-con operator. In this position Mr. Mitchell, managed all aspects of drilling and completion activities including running 4 rigs for a three-year period, drilling 48 horizontal wells and growing production to over 30,000 barrels per day.

Mr. Mitchell earned a Bachelor of Science degree in Natural Gas Engineering from Texas A&I University

Art Green is the Senior Advisor for Oracle Energy and a member of the Board of Directors. He is a seasoned oil and gas executive with over 40 years of experience in the industry in technical and leadership roles. Mr. Green has been with Oracle since 2008 and has recently been heavily involved in the development of the Texas opportunity.

Art Green is the Senior Advisor for Oracle Energy and a member of the Board of Directors. He is a seasoned oil and gas executive with over 40 years of experience in the industry in technical and leadership roles. Mr. Green has been with Oracle since 2008 and has recently been heavily involved in the development of the Texas opportunity.

Mr. Green’s work history includes senior leadership responsibilities; as VP of Producing and Director for Mobil Oil Canada, President and General Manager for Mobil Equatorial Guinea, and Country Manager for Hess in Russia. He has extensive experience in facility engineering, project management, production management, development planning and implementation, P&L responsibility, and organizational change.

Mr. Green’s major projects include organizational change leadership at Mobil Canada, development of Mobil’s Zafiro Field in Equatorial Guinea including PSC negotiation, and implementation of Hess’s JV in Russia.

Mr. Green holds a Mechanical Engineering degree from the University of Saskatchewan. He is a hands-on Manager with; technical, leadership, financial, and commercial skills.

Mark Forster is Interim Chief Financial Officer and joined the company in 2006. Mr. Forster has 30 years of experience in financial and management accounting for banking, manufacturing, oil and gas, and mining companies. His prior CFO experience includes Teletouch Services and MYM Nutraceuticals. Mr. Forster was also a manager at BearingPoint (KPMG). He is a Chartered Public Accountant (CPA, CGA) registered in British Columbia and studied Accounting at the University of British Columbia and British Columbia Institute of Technology.

Mark Forster is Interim Chief Financial Officer and joined the company in 2006. Mr. Forster has 30 years of experience in financial and management accounting for banking, manufacturing, oil and gas, and mining companies. His prior CFO experience includes Teletouch Services and MYM Nutraceuticals. Mr. Forster was also a manager at BearingPoint (KPMG). He is a Chartered Public Accountant (CPA, CGA) registered in British Columbia and studied Accounting at the University of British Columbia and British Columbia Institute of Technology. Nasim Tyab is the Founder and Capital Markets Strategies for Oracle Energy Corp. Mr. Tyab is a businessman with a background in management, corporate development and public company finance. He has over 25 years of experience with public companies and has served as a director and senior officer of a number of public companies, principally in the minerals and energy sectors.

Nasim Tyab is the Founder and Capital Markets Strategies for Oracle Energy Corp. Mr. Tyab is a businessman with a background in management, corporate development and public company finance. He has over 25 years of experience with public companies and has served as a director and senior officer of a number of public companies, principally in the minerals and energy sectors.

He has been the President of Oracle Energy Corp. since 2000 and was the President of Senco Sensors Inc from 1995 to 2001. Mr. Tyab was a co-founder and director of Mohave Exploration and Production Inc. from November 2006 to August 2010, an oil and gas company which had amalgamated with Porto Energy Corp raising $100 million.

Mr. Tyab received a Bachelor of Arts degree from Simon Fraser University in 1995.

Oracle has additional highly qualified people who will formally be joining the organization as funding plans are implemented.

- Low risk developmental opportunities with exceptional risk adjusted returns, high working interest, Oracle operated assets

- Targeting the highly productive Eagle Ford Formation

- Stacked pay with five producing horizons including and Austin Chalk

- Drilling and completion technology application to yield EURs exceeding 700,000 barrels of oil per well

HISTORY

Oracle recently announced the acquisition of oil and gas assets in the trend.

Historically, Oracle was involved in frontier exploration and more recently in seeking Development opportunities in West Africa.

Oracle has restructured management and turned its exclusive focus to North American opportunities. Having reviewed various plays in the US Oracle has identified superior opportunity in the Texas Eagle Ford.

Management’s prior work experience and relationships in Texas brought about the Company’s current focus on in the Oil Window.

Source: http://www.oracleenergy.com/