GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

Vancouver, BC – May 5, 2021 – Canadian Palladium Resources Inc. (CSE: BULL) (OTCQB: DCNNF) (FSE: DCR1) (the “Company”) is pleased to provide new assay results for drill holes EB-21-51, EB-21-52, and EB-21-53 at the East Bull Palladium Deposit, located 90 kilometres west of Sudbury, Ontario. These drill holes extend the main Garden/Valhalla Zone palladium mineralization 250 m along strike to the west and intersected a new zone of mineralized inclusion-bearing gabbro located 50 m below the Garden Zone that is interpreted as a feeder dyke or magma conduit for the East Bull Intrusion.

Highlights of the current drill results are:

- Hole EB-21-52 intersected both the Garden Zone and a new mineralized inclusion-bearing gabbro that assayed 41 g/t Pd Eq over 7 m from 223.0 to 230.0 m, however, the hole terminated in mineralized gabbro. The Company plans to extend this hole to determine the full extent of the new zone that is interpreted as a feeder dyke;

- Hole EB-21-53 intersected 2.38 g/t Pd Eq over 6.0 m from 173.0 to 179.0 m. This interval is in the Garden Zone where mineralization is hosted in vari-textured gabbro that has shown consistent mineralization for over 2.5 km strike length.

Wayne Tisdale, Canadian Palladium’s CEO, commented, “The discovery of a deeper zone below the main Valhalla/Garden Zone mineralization presents exciting new potential for the East Bull Project. The Company’s geologists consider that the new zone may be a mineralized feeder dyke or magma conduit that is a potentially favourable structure for localizing high-grade mineralization. We look forward to getting back on this new target as soon as site conditions permit access after spring breakup.”

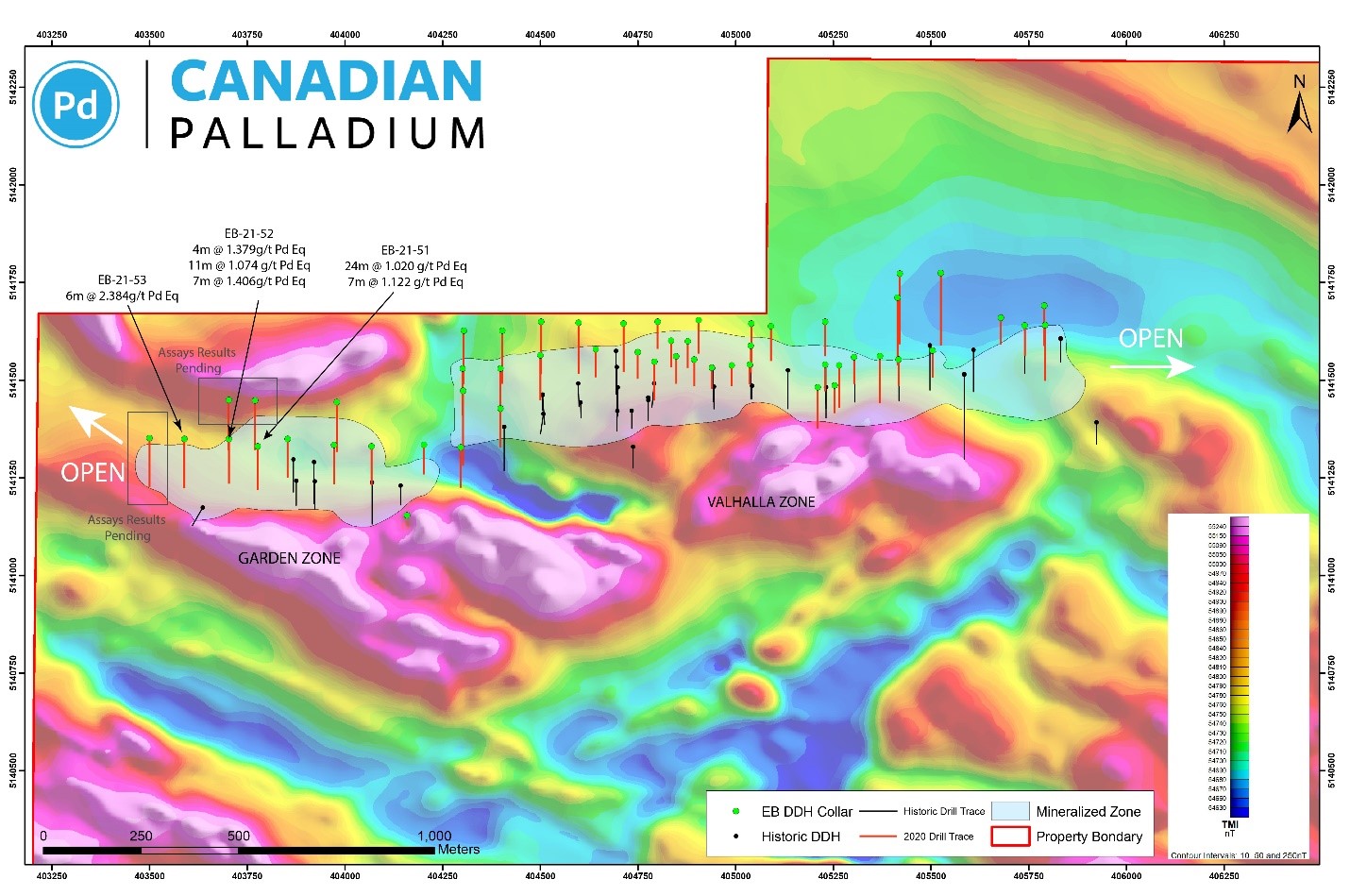

Mineralized intervals from holes EB-21-5, EB-21-52 and EB-21-53 are reported in Table 1. Appendix 1 provides details of hole locations and orientations. Figure 1 shows the locations of the drill holes.

Table 1: Diamond Drill Hole Results EB-21-51, 52, & 53

| Hole ID | From (Metres) | To (Metres) | Width (Metres) | Pd g/t | Pt

g/t |

Au g/t | Cu

% |

Ni

% |

Co

% |

3PGM + Au g/t | Pd Eq Grams per Ton |

| EB-21-51 | 83 | 107 | 24 | 0.488 | 0.170 | 0.037 | 0.084 | 0.032 | 0.006 | 0.695 | 1.020 |

| and | 126 | 133 | 7 | 0.456 | 0.203 | 0.050 | 0.118 | 0.031 | 0.006 | 0.710 | 1.122 |

| EB-21-52 | 104 | 108 | 4 | 0.587 | 0.185 | 0.071 | 0.160 | 0.044 | 0.007 | 0.842 | 1.379 |

| and | 159 | 170 | 11 | 0.488 | 0.151 | 0.048 | 0.097 | 0.052 | 0.006 | 0.687 | 1.074 |

| Feeder Dyke | 223 | 230 | 7 | 0.379 | 0.013 | 0.065 | 0.307 | 0.036 | 0.008 | 0.571 | 1.406 |

| EB-21-53 | 173 | 179 | 6 | 1.225 | 0.500 | 0.057 | 0.153 | 0.053 | 0.007 | 1.782 | 2.384 |

- Individual demarked samples were sawn in half, bagged, sealed and transported by courier to the laboratory. Duplicates, blanks and standards were introduced to the sample stream on site. Samples were sent to AGAT Laboratories, Mississauga, Ontario. Each sample was analysed using the AGAT Laboratories codes 202555, Fire Assay-ICP (50g); 201070, 4 Acid Digest / ICP-OES Finish.

- Reported widths are drilled widths, with true widths estimated to be 90 per cent of drilled widths for minus-60-degree-holes to approximately 85 per cent of drilled width for minus-70-degree holes.

- Pd-Eq grade based on parameters in the May 23, 2019, NI 43-101 Resource Estimate and Technical Report. Metal prices are based on 24-month trailing averages at January 31, 2018. In US$ these prices are: Pd – $767/oz; Pt – $973/oz; Rh – $1,000/oz; Au – $1.262/oz; Cu – $2.53/lb; Ni – $4.62/lb; Co – $20/lb.

The Company’s protocol is to analyze Rh after initially assaying for palladium, platinum and gold. Once Rh results are received, the Rh concentrations will be reported and Rh will be included as a component of 3PGM (palladium+platinum+rhodium) and included in calculations of palladium equivalent (PdEq).

The Company is currently drilling and assay results from holes EB-21-54 to EB-21-57 are in progress. The Valhalla/Garden Zone Palladium mineralization is hosted within a 45° north dipping vari-textured gabbro unit near the basal contact of the East Bull Gabbro. Drilling has successfully focused on testing the on strike and downdip extension of this “contact-type” mineralization. Such mineralization structures are typically tens of metres thick.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

Canadian Palladium Resources Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4472

Figure 1. Drill intersections reported in this release relative to Garden and Valhalla Zones of the East Bull Palladium Deposit. Base map is airborne total field magnetic survey.

Appendix 1. Drill Hole Location information

| HOLE-ID | UTM E | UTM N | LENGTH | AZIMUTH | DIP |

| EB-21-51 | 403777 | 5141331 | 225 | 180 | -60 |

| EB-21-52 | 403703 | 5141350 | 230 | 180 | -60 |

| EB-21-53 | 403589 | 5141350 | 251 | 180 | -60 |

Drill collar coordinates are in NAD83 UTM 17N

Reader Advisory

This news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward-looking information in this press release includes, but is not limited to, statements with respect to the analytical results and exploration at the East Bull palladium property.

Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; liabilities inherent in water disposal facility operations; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive. The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Canadian Palladium Resources Inc.

Vancouver, BC – August 26, 2020 – Canadian Palladium Resources Inc. (formerly 21C Metals Inc.) (the “Company”) (CSE: BULL) (OTCQB: DCNNF) (FSE: DCR1) is pleased to announce preliminary assay results for diamond drill holes EB20-11 through EB20-20 on the Company’s East Bull Palladium Project (the “Project”), located in the Sudbury mining district, Ontario. The drilling intersected wide intervals of palladium mineralization that extend down dip from the current Mineral Resource.

Results include:

EB20-12 with 22.0 m at 2.24 g/t Palladium Equivalent (PdEq);

EB20-17 with 23.0 m at 1.54 g/t Pd-Eq; and

EB20-20 with 32.0 m at 1.43 Pd-Eq.

These intervals are preliminary results that do not include rhodium (Rh). At East Bull, Rh is a significant contributor to the Palladium-equivalent (Pd-eq) grade along with platinum (Pt), copper (Cu), gold (Au), nickel (Ni) and cobalt (Co). In addition, hole EB20-20 has not been completely sampled. Results will be updated when additional results have been received.

Mr. Garry Clark, Director, commented, “Canadian Palladium is pleased with these drill results that show significant widths of “contact-type” palladium mineralization extending down dip from the current 523,000 oz PdEq Mineral Resource. The Deposit dips north from surface at approximately 45o and presents a favourable orientation for a pit-constrained Mineral Resource. Mineralization is open at depth and along strike. We look forward to releasing more results from our on-going drill program.”

Palladium exploration targets at the East Bull Project include:

- Near-surface “contact-type” palladium mineralization (tens of meters thick) associated with disseminated sulphides in the “inclusion-bearing gabbro” on the southern margin of the East Bull Gabbro intrusion;

- High-grade “layered mineralization” (meters thick) associated with high PGM tenor sulphides in the upper part of the “inclusion bearing gabbro”,

Additionally, there is discovery potential for structurally controlled “conduit-type” targets that may vertically extensive.

Drill Results – The intersections reported in this release are located in the central and eastern portions of the East Bull Property.

| DDH# | Az/Dip | From (m) | To

(m) |

Width (m) | Pd

g/t |

Pt

g/t |

Au

g/t |

Cu

% |

Ni

% |

Co

% |

2PGM+Au g/t | PdEq g/t |

| EB20-11 | 180o/-70o | 104.0 | 108.0 | 4.0 | 0.633 | 0.242 | 0.041 | 0.081 | 0.024 | 0.007 | 0.916 | 1.25 |

| EB20-12 | 180o/-45o | 45.0 | 67.0 | 22.0 | 1.239 | 0.428 | 0.049 | 0.119 | 0.064 | 0.008 | 1.714 | 2.24 |

| incl | 51.0 | 53.0 | 2.0 | 3.425 | 1.380 | 0.093 | 0.196 | 0.110 | 0.012 | 4.898 | 5.93 | |

| EB20-13 | 180o/-70o | 58.0 | 76.0 | 18.0 | 0.475 | 0.142 | 0.038 | 0.121 | 0.042 | 0.008 | 0.654 | 1.08 |

| EB20-15 | 180o/-70o | 124.0 | 126.0 | 2.0 | 0.575 | 0.160 | 0.010 | 0.020 | 0.035 | 0.006 | 0.746 | 0.92 |

| EB20-17 | 180o/-70o | 93.0 | 116.0 | 23.0 | 0.651 | 0.239 | 0.072 | 0.132 | 0.097 | 0.009 | 0.962 | 1.54 |

| EB20-18 | 180o/-70o | 72.0 | 92.0 | 20.0 | 0.522 | 0.206 | 0.030 | 0.104 | 0.065 | 0.006 | 0.758 | 1.18 |

| and | 96.0 | 110.0 | 14.0 | 0.498 | 0.221 | 0.053 | 0.183 | 0.085 | 0.009 | 0.772 | 1.43 | |

| EB20-19 | 180o/-70o | 69.0 | 76.0 | 7.0 | 1.078 | 0.386 | 0.041 | 0.096 | 0.071 | 0.007 | 1.505 | 1.97 |

| and | 84.0 | 113.0 | 29.0 | 0.553 | 0.229 | 0.052 | 0.111 | 0.082 | 0.009 | 0.834 | 1.33 | |

| EB20-20 | 180o/-70o | 99.0 | 131.0 | 32.0 | 0.554 | 0.200 | 0.068 | 0.174 | 0.070 | 0.007 | 0.823 | 1.43 |

Mineralization is contained within the north dipping “inclusion-bearing zone” near the south contact of the Early Proterozoic East Bull Gabbro intrusion. Drill holes EB20-11, -12, -13, drilled in the eastern part of the Property, intersected mineralization that extends the eastern part of the Deposit down dip. Hole EB20-12 included a 2.0 m intersection of 5.93 g/t PdEq that is an extension of the high-grade “layered” mineralization reported in the Company’s August 18, 2020 press release.

Holes EB20-17 to EB20-20 intersected wide zones of “contact mineralization” in the central part of the Deposit over a strike length of approximately 200 m and to depths of approximately 130 m. These holes extend mineralization 50 m down dip from the current Mineral Resource and mineralization remains open at depth. Length weighted Pd-Eq grades for the intersections in holes EB20-17 to -20 are consistent with the current Mineral Resource grade.

Drill holes EB20-14, -15, -16 intersected an approximately 50 m wide zone of dykes and faulting that trends at approximately 070o and dips steeply south. These holes intersected only minor intervals of palladium mineralization. The structure has similarities with the Parisien Lake Deformation Zone located 3 km east of the Property and is potentially a host for “conduit-type” mineralization in the East Bull Gabbro.

The results are part of a 10,000 m drill program with a primary objective of expanding the current Inferred Mineral Resource. The diamond drill holes were all drilled at an azimuth of 180o with inclinations ranging from -45o to -70o. Reported widths are drilled widths, with true widths estimated to be 100% for -45o holes to approximately 80% of drilled width for -70o holes.

Palladium equivalent “PdEq” is calculated with US$ metal prices based on 24-month trailing averages as of January 31, 2018 and assumptions on concentrate recovery, smelter payable and refining charges based on comparable projects that were used in the Company’s 2019, NI 43-101 Technical Report and Mineral Resource Estimate for the East Bull Property.

Drill Program QA/QC – This phase of the drilling program was carried out under the supervision of Garry Clark, P. Geo., of Clark Exploration Consulting, a Qualified Person as defined in NI 43-101. Drill core samples were split using a rock saw by Company staff, with half retained in the core box and stored in the Company’s facility in Massey, Ontario. The drill core samples were transported in sealed bags by courier to Activation Laboratories (“Actlabs”) in Ancaster, Ontario. Actlabs is an independent ISO/IEC 17025 certified laboratory. PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-AES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.25 grams with an ICP-AES finish. Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used.

East Bull Project Mineral Resource Estimate – P&E Mining Consultants Inc. of Brampton, Ontario has previously prepared a NI 43-101 Mineral Resource Estimate and Technical Report on the Property for the Company dated May 23, 2019 (the “43-101 Report”) and filed on SEDAR on August 6, 2019. The NI 43-101 Technical Report estimates a pit-constrained Inferred Mineral Resource of 11.1 million tonnes of 1.46 grams per tonne (523,000 ounces) palladium equivalent. The Property consists of approximately 1,000 hectares covering more than 3.6 kilometres strike length of the of the palladium mineralized “Inclusion-bearing zone” of the East Bull layered gabbroic intrusion.

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues, although Pavey Ark is not aware of any such issues.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

(4) Values in the table may differ due to rounding.

(5) PdEq grade based on parameters in May 23, 2019 NI43-101 Resource Estimate and Technical Report. Metal prices are based on 24-month trailing averages at January 31, 2018. In US$ these prices are: Pd – S767/oz; Pt – $973/oz; Rh – $1,000/oz; Au – $1.262/oz; Cu – $2.53/lb; Ni – $4.62/lb; Co – $20/lb.

Mr. Eugene Puritch, P.Eng., President of P&E Mining Consultants Inc., is the independent Qualified Person (as defined in NI 43-101) responsible for preparing the NI 43-101 Technical Report on the Property. Mr. Puritch has reviewed and approved the technical contents of this press release as they pertain to the Mineral Resource Estimate on the Property. Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is Canadian Palladium’s “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release that pertains to the current drilling program.

Canadian Palladium Resources Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4472

Reader Advisory

This news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward-looking information in this press release includes, but is not limited to, statements with respect to the proposed timing and completion of the private placement and the proposed use of proceeds from the private placement. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; liabilities inherent in water disposal facility operations; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Vancouver, BC – August 18, 2020 – Canadian Palladium Resources Inc. (formerly 21C Metals Inc.) (the “Company”) (CSE: BULL) (OTCQB: DCNNF) (FSE: DCR1) is pleased to announce complete assay results for the first ten (10) holes drilled on the Company’s East Bull Palladium Project, located in the Sudbury mining district, Ontario. The results include several high-grade palladium intersections with significant platinum (Pt), rhodium (Rh), gold (Au), and copper (Cu) with associated nickel (Ni) and cobalt (Co).

Results include:

EB20-01 with 4.0 m at 8.15 g/t Palladium Equivalent (Pd-Eq);

EB20-03 with 3.0 m at 6.29 g/t Pd-Eq; and

EB20-07 with 3.0 m at 7.47 Pd-Eq.

These high-grade intervals are part of wider intervals of mineralization that include: 15.0 m at 2.69 g/t Pd-Eq in hole EB20-03; and 24.0 m at 2.14 g/t Pd-Eq in hole EB20-07.

Garry Clark P.Geo, Director commented, “Canadian Palladium is pleased with the results from the initial holes in this program. These intersections report complete assay results that include palladium, platinum, rhodium, gold, copper, nickel and cobalt. High-grade palladium intersections are rare and these results have exceeded our grade expectations based on Canadian Palladium’s 2019 Inferred Mineral Resource Estimate of 523,000 oz Pd-Eq at a grade of 1.46 g/t Pd-Eq for East Bull. We look forward to releasing additional results on this exciting Project.”

East Bull Target Models – Palladium exploration targets at the East Bull Project include:

- Near-surface “contact-type” palladium mineralization (ten’s of meters thick) associated with disseminated sulphides in the “inclusion-bearing gabbro” on the southern margin of the East Bull Gabbro intrusion; and

- High-grade “layered mineralization” (meters thick) associated with high PGM tenor sulphides in the upper part of the “inclusion bearing gabbro”.

Additionally, there is discovery potential for structurally controlled “conduit-type” targets that may vertically extensive.

Drill Results – The reported intersections are located on the eastern portion of the Property. The results are part of a 10,000 m drill program with a primary objective of expanding the current Inferred Resource. High-grade intervals occur in the upper part of the “Valhalla Zone” and extend for over 150 m strike length from EB20-03 to EB20-07. A figure showing the hole locations is provided at the end of the release. Currently, drilling is focussed in the western portion of the Property.

| East Bull Palladium Drill Significant Drill Intersections – Drill Holes EB20-01 to EB20-10 | |||||||||||||

| DDH# | Az/

Dip |

From (m) | To

(m) |

Width (m) | Pd

g/t |

Pt

g/t |

Rh

g/t |

Au

g/t |

Cu

% |

Ni

% |

Co

% |

3PGM+Au g/t | PdEq g/t |

| EB20-01 | 180o/-45o | 28.0 | 38.0 | 10.0 | 2.505 | 1.123 | 0.080 | 0.146 | 0.235 | 0.118 | 0.007 | 3.854 | 4.94 |

| incl | 29.0 | 33.0 | 4.0 | 4.286 | 1.919 | 0.130 | 0.258 | 0.312 | 0.158 | 0.007 | 6.593 | 8.15 | |

| EB20-02 | 180o/-70o | 37.0 | 42.0 | 5.0 | 1.136 | 0.384 | 0.032 | 0.051 | 0.142 | 0.088 | 0.008 | 1.605 | 2.21 |

| EB20-03 | 180o/-45o | 27.0 | 42/0 | 15.0 | 1.259 | 0.530 | 0.032 | 0.079 | 0.193 | 0.103 | 0.008 | 1.901 | 2.69 |

| incl. | 28.0 | 31.0 | 3.0 | 3.105 | 1.597 | 0.084 | 0.151 | 0.286 | 0.147 | 0.008 | 4.938 | 6.29 | |

| EB20-06 | 180o/-50o | 70.0 | 74.0 | 4.0 | 0.784 | 0.220 | 0.012 | 0.041 | 0.117 | 0.045 | 0.005 | 1.056 | 1.48 |

| EB20-07 | 180o/-45o | 109.0 | 133.0 | 24.0 | 1.036 | 0.405 | 0.025 | 0.084 | 0.148 | 0.051 | 0.008 | 1.550 | 2.14 |

| incl. | 112.0 | 115.0 | 3.0 | 4.224 | 1.600 | 0.108 | 0.231 | 0.284 | 0.085 | 0.008 | 6.163 | 7.47 | |

| EB20-08 | 180o/-70o | 66.0 | 72.0 | 6.0 | 0.531 | 0.258 | 0.021 | 0.055 | 0.195 | 0.048 | 0.007 | 0.864 | 1.50 |

| EB20-09 | 180o/-70o | 58.0 | 62.0 | 4.0 | 0.922 | 0.489 | 0.030 | 0.052 | 0.110 | 0.0310 | 0.006 | 1.493 | 1.96 |

Mineralization is contained within the north dipping “inclusion-bearing zone” near the south contact of the Early Proterozoic East Bull Gabbro intrusion. Drill holes EB20-04, -05, and -10 intersected a structure with late diabase dykes and did not intersect significant palladium values. Current drilling indicates the mineralization continues on the northwest side of the 060o to 075o striking dyke structure that is approximately 50 m wide.

The diamond drill holes were all drilled at an azimuth of 180o with dips ranging from -45o to -70o. Reported widths are drilled widths, with true widths estimated to be 100% for -45o holes to approximately 80% of drilled width for -70o holes.

Palladium equivalent “Pd-Eq” is calculated with US$ metal prices based on 24-month trailing averages as of January 31, 2018 and assumptions on process recovery, smelter payable and refining charges based on comparable projects that were used in the Company’s 2019, NI 43-101 Technical Report and Mineral Resource Estimate for the East Bull Property.

Drill Program QA/QC – This phase of the drilling program was carried out under the supervision of Garry Clark, P. Geo., of Clark Exploration Consulting, a Qualified Person as defined in NI43-101. Drill core samples were split using a rock saw by Company staff, with half retained in the core box and stored in the Company’s facility in Massey, Ontario. The drill core samples were transported in sealed bags by courier to Activation Laboratories (“Actlabs”) in Ancaster, Ontario. Actlabs is an independent ISO/IEC 17025 accredited laboratory. PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-AES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.25 grams with an ICP-AES finish. Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used.

East Bull Project Resource Estimate – P&E Mining Consultants Inc. of Brampton, Ontario has previously prepared a NI 43-101 Mineral Resource Estimate and Technical Report on the Property for the Company dated May 23, 2019 (the “43-101 Report”) and filed on SEDAR on August 6, 2019. The NI 43-101 Technical Report estimates a pit-constrained Inferred Mineral Resource of 11.1 million tonnes of 1.46 grams per tonne (523,000 ounces) palladium equivalent. The Property consists of approximately 1,000 hectares covering more than 3.6 kilometres strike length of the of the palladium mineralized “Inclusion-bearing zone” of the East Bull layered gabbroic intrusion.

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues, although Pavey Ark is not aware of any such issues.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

(4) Values in the table may differ due to rounding.

(5) PdEq grade based on parameters in May 23, 2019 NI43-101 Resource Estimate and Technical Report. Metal prices are based on 24-month trailing averages at January 31, 2018. In US$ these prices are: Pd – S767/oz; Pt – $973/oz; Rh – $1,000/oz; Au – $1.262/oz; Cu – $2.53/lb; Ni – $4.62/lb; Co – $20/lb.

Mr. Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc., is the independent qualified person (as defined in NI 43-101) responsible for preparing the NI 43-101 Technical Report on the Property. Mr. Puritch has reviewed and approved the technical contents of this press release as they pertain to the Mineral Resource Estimate on the Property. Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is Canadian Palladium’s “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release that pertains to the current drilling program.

Canadian Palladium Resources Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4472

Reader Advisory

This news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward-looking information in this press release includes, but is not limited to, statements with respect to the advancement of drilling program and the palladium potential on the East Bull property. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; liabilities inherent in water disposal facility operations; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive. The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Canadian Palladium Resources Inc.

Looking to expand on near surface 523,000 oz resource

Vancouver, BC – October 15, 2019 – 21C Metals Inc. (CSE: BULL) (FRA: DCR1) (OTCQB: DCNNF) (“21C Metals” or the “Company”) is pleased to announce the awarding of a diamond drill contract to Vital Drilling of Val Caron, Ontario. The diamond drill program comprised of 10 to 15 holes will commence within the next week.

Following on from a successful summer sampling program (Press Release September 17, 2019) the diamond drill program will focus on expanding the Pit Constrained Inferred Mineral Resource Estimate of 523,000 Palladium Equivalent (PdEq) ounces and determining a potential higher grade starter pit location.

Drill holes have been selected by 21C Metals geologists with the assistance of technical advisor Richard H. Sutcliffe, PhD, PGeo. The NI 43-101 Initial Mineral Resource Estimate (Table 1) for the East Bull Palladium Project is filed on https://www.sedar.com/.

The recent demand for Palladium has driven the Palladium price to over $1,600/oz (USD). The implementation of cleaner emission standards by governments around the world has increased the use of Palladium and Platinum in catalytic converters for internal combustion powered vehicles. This demand has been supported by the growth in sales of hybrid vehicles which are growing faster than electric car sales. Supply is already constrained and wage negotiation deadlocks in South Africa may potentially further effect supply[1].

East Bull is located ~ 90 kilometers west of Sudbury Ontario. Sudbury is home to the fully integrated base and precious metal mining, processing, and smelting complexes of Vale Canada Limited and Glencore PLC.

Wayne Tisdale, President of 21C Metals, commented: “We are pleased to be able to move our exploration program forward so rapidly after such a successful summer sampling campaign. This has been possible thanks to our excellent geological and operational teams and the ease of accessibility of the project”.

P&E Mining Consultants Inc. has completed a Technical Report and Initial Mineral Resource Estimate on the East Bull Property for the Company. The Pit Constrained Inferred Mineral Resource Estimate at a 0.8 g/t PdEq cut-off is summarized in Table 1.

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues, although 21C Metals is not aware of any such issues.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

(4) Values in the table may differ due to rounding.

The PdEq cut-off is based on the following 24-month trailing average US$ metal prices as of January 31, 2018: Pd – $767/oz; Pt – $973/oz; Au – $1,262/oz; Rh – $1,000/oz; Cu – $2.55/lb; Ni – $4.62/lb; Co – $20/lb. In addition to metal prices, the PdEq cut-off grade takes into consideration assumptions for mining costs, concentrate recoveries, smelter payables and refining charges that are summarized in the NI43-101 technical report.

Information regarding the NI43-101 technical report and resource estimate in this news release has been reviewed and approved by Independent Qualified Person, Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

To join 21C Metals’ investor group please follow this link: http://bit.ly/Join21CGroup.

For additional information please contact:

21C Metals Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4455

Investors are cautioned that the estimates do not mean or imply that economic deposits exist on the Property. Other than as provided for in this press release, the Company has not undertaken any independent investigation of the estimates or other information contained in this press release nor has it independently analyzed the results of the previous exploration work in order to verify the accuracy of the information. The Company believes that the information contained in this press release are relevant to continuing exploration on the Property because they identify significant mineralization that will be the target of the Company’s exploration program.

For Notice

Pavey Ark’s samples were analyzed by Actlabs in Ancaster, Ontario. All samples were transported under the direct supervision of R.H. Sutcliffe and delivered from the Project directly to the laboratory receiving facilities of Actlabs in Ancaster, Ontario. Samples were analyzed for Pt, Pd, Au by 50 g fire assay with ICP-OES finish and for Ag, Co, Cu, Ni by total digestion with an ICP finish at Actlabs, in Ancaster, ON. Rh was analyzed separately by 30 g fire assay with ICP-MS finish at Actlabs in Ancaster, ON.

Actlabs is an independent commercial laboratory that is ISO 9001 certified and ISO 17025 accredited. The accreditation program includes ongoing audits to verify the QA system and all applicable registered test methods.

Actlabs has developed and implemented a Quality Management System (QMS) designed to ensure the production of consistently reliable data at each of its locations including the Ancaster laboratories. The system covers all laboratory activities and takes into consideration the requirements of ISO standards. Actlabs maintains ISO registrations and accreditations. ISO registration and accreditation provide independent verification that a QMS is in operation at the location in question.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Source: 21C Metals Inc.

[1] https://www.reuters.com/article/global-precious/precious-palladium-sets-all-time-high-on-supply-angst-gold-pares-gains-idUSL3N2632YO

Vancouver, BC – September 17, 2019 – 21C Metals Inc. (CSE: BULL) (FRA: DCR1) (OTCQB: DCNNF) (“21C Metals” or the “Company”) is pleased to announce the following highlights from the first sampling program on the East Bull Palladium Project and field program on the Agnew Lake Project: The East Bull Property hosts an inferred resource of 11.1 million tons @ 1.46 g/t Palladium Equivalent (Pd Eq) for a total estimate of 523,000 ounces of PdEq (See July 3 press release and below).

East Bull Property:

The grab sampling and mapping of the East Bay Palladium mineralization has allowed 21C to determine locations to channel sample. The sampling focused on selecting sample locations that were not previously documented. The sampling and mapping were successful in defining areas of the mineralization that when channel sampled will provide economic mineralized intercepts that will increase confidence of the mineral resource. The channel samples will also allow definition of areas of higher grade Palladium that could to direct 21C to potential starter pit locations. The channel sample is a continuous sample cut using a diamond bladed rock saw.

- 73 grab samples selected to help identify the Palladium bearing rock types of the mineralized trend. Grab samples are used to determine the presence mineralization and may not be indicative of the overall grade of the zone.

- Sampling successfully defined locations for channel sampling and the higher grades could indicate potential zones within the mineralized zone for higher grade starter pits.

- Range of Palladium assay sample results (1000 ppb is equivalent to 1.0 grams per ton).

| Number of Samples | Range Palladium (ppb) |

| 8 | Below detection limit |

| 29 | < 100 |

| 17 | 101 to 500 |

| 5 | 501 to 1000 |

| 5 | 1001 to 2000 |

| 6 | 2001 to 4000 |

| 3 | 4001 to 6569 |

- Twelve (12) samples had values of >2000 ppb (2.0 grams per ton) Platinum + Palladium + Gold.

| Sample No. | Palladium (Pd) ppb | Platinum (Pt) ppb | Gold (Au) ppb |

| E5928403 | 2135 | 641 | 176 |

| E5928415 | 6569 | 3340 | 652 |

| E5928416 | 2244 | 819 | 107 |

| E5928417 | 1602 | 401 | 74 |

| E5928418 | 3101 | 791 | 279 |

| E5928428 | 2784 | 908 | 118 |

| E5928430 | 3967 | 1827 | 230 |

| E5928431 | 5543 | 1862 | 440 |

| E5928432 | 4513 | 1354 | 188 |

| E5928365 | 1402 | 573 | 90 |

| E5928374 | 1830 | 481 | 139 |

| E5928377 | 3931 | 1024 | 174 |

- Geological mapping and review of the Freewest diamond drilling in 2000, indicates the northeast trending faults are composed of multi intrusions of mafic to diabase dikes. Left lateral movement on the dikes is measured to be up to 100 meters.

Agnew Lake Property:

- Review of historical data indicated that various Palladium-Platinum showings were acquired within the staked area.

- A two-week prospecting and grab sampling program was completed to assess the locations and grade of the various showings.

- A total of 58 samples have been submitted to the lab.

Mr Wayne Tisdale commented, “The grab sample program has helped confirm the palladium bearing rock types and highlighted key areas to be targeted by a trenching program. While any grab sample grades are to be treated with caution, we are very pleased with the initial sampling program and can look forward to the trenching results with confidence.”

Grab samples are selected samples and are not necessarily indicative or reflective of mineralization that may be hosted on the property.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

To join 21C Metals’ investor group please follow this link: http://bit.ly/Join21CGroup.

For additional information please contact:

21C Metals Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4455

The Company believes that the information contained in this press release is relevant to continuing exploration on the Property because they identify significant mineralization that will be the target of the Company’s exploration program.

21C Metals geologists delivered the samples to the SGS Canada Inc. preparation facility in Sudbury and analysis was completed at the SGS lab in Lakefield, ON. Gold, platinum and palladium are analysed using a fire assay (30 gm) with an inductively coupled plasma mass spectrometry (ICP-AES) finish (method code: GE-FA1313). Detection limits are Au: 1 ppb; Pt: 10 ppb; and Pd 1 ppb.

Base metals are analyzed using a multi-element atomic emission spectroscopy (ICP-OES; method code GO-ICP90Q) technique following Na2O2 fusion.

For prospecting sampling 21C relied on the SGS internal QA/QC process.

The Company engaged P&E Mining Consultants Inc. to complete a Technical Report and Initial Mineral Resource Estimate on the East Bull property (see July 3, 2019 press release).

The PdEq calculation is based on the assumptions in Table 14.2. Metal prices are based on 24 month trailing averages at January 31, 2018. Concentrate recovery, smelter payables and refining charges are based on comparable projects.

* January 31, 2018 two year trailing average prices

Using these assumptions the PdEq in g/t is calculated as:

PdEq g/t = (Ni % x 1.36) + (Cu % x 2.18) + (Au g/t x 1.43) + (Pt g/t x 1.24) + (Rh g/t x 1.27) + (Co % x 7.38) + Pd g/t

Mineral Resource Estimate PdEq Cut-Off Grade Calculation CDN$

Pd Price US$914/oz

$US=$CDN Exchange Rate $ US$0.77 = CAD$1.00

Pd Recovery 80%

Smelter Payable 90%

Mining Cost $2.00/t

Overburden Mining $1.50/t

Process Cost $18/t

G&A Cost $4/t

Therefore, the PdEq cut-off grade for the pit constrained Mineral Resource Estimate is calculated as follows:

Operating costs per mineralized tonne = ($18 + $4) = $22/tonne

[($22)/[($914/$0.77 Exchange Rate/ 31.1035 x 80% Recovery x 90% Payable)] = 0.8 g/t Pd

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues, although 21C Metals is not aware of any such issues.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

(4) Values in the table may differ due to rounding.

A technical report supporting the mineral resource is filed on SEDAR.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Source: 21C Metals Inc.

Vancouver, BC – July 17, 2019 – 21C Metals Inc. (CSE: BULL) (OTCQB: DCNNF) (FRA: DCR1) (“21C Metals” or the “Company”) is pleased to announce the acquisition of a significant palladium project in Ontario. The Agnew Lake property was acquired after discussions with the company’s advisors and review of the Ontario Government geological data base. The Agnew Lake Property is located 80 kilometres west of Sudbury, Ontario home of Glencore and Vale’s Canadian Nickel-Copper-Platinum Group Elements mining and smelting operations.

The Agnew Lake Property is comprised of over 260 claims (~6000 Ha) and is part of the larger East Bull Lake-Agnew Lake mafic-ultramafic complex. The Company believes this acquisition will position it to be one of the larger none producing palladium explorers in North America.

The Agnew Lake magmas have major element compositions that are very similar to the model parent liquids proposed for the mafic portions of the Stillwater and Bushveld Complexes. The Agnew Intrusion and the East Bull Lake Intrusion are also considered to host significant PGE–Cu–Ni mineralization in marginal rock units (Peck & James, 1990; Peck et al.,1993a, 1993b, 1995; Vogel et al., 1997).

The Company continues exploration methods on the East Bull Property and surface grab sample results from geological structural mapping should be available in 3 weeks. (Grab samples are selective in composition and may not be representative of the total mineralized body). Continuation of exploration will include evaluation of the Agnew Lake Property. Detailed compilation of public data on Agnew Lake Property has commenced and a search for privately held data has started.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

For additional information please contact:

21C Metals Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4455

Investors are cautioned that the estimates do not mean or imply that economic deposits exist on the Property. Other than as provided for in this press release, the Company has not undertaken any independent investigation of the estimates or other information contained in this press release nor has it independently analyzed the results of the previous exploration work in order to verify the accuracy of the information. The Company believes that the information contained in this press release are relevant to continuing exploration on the Property because they identify significant mineralization that will be the target of the Company’s exploration program.

Source: 21C Metals Inc.

Vancouver, BC – July 12, 2019 – 21C Metals Inc. (CSE: BULL) (FSE: DCR1) (OTCQB: DCNNF) (“21C Metals” or the “Company”) is pleased to announce the commencement of exploration on the German portion of the Tisova project. The aim of the exploration is to assess the Copper – Cobalt potential in the interpreted rift system that hosts the Tisova Copper-Cobalt past producer in the Czech Republic.

The Company has contracted Beak Consultants of Germany to complete a geological comprehensive data compilation and field study to evaluate the copper-cobalt anomalies defined by the German Government geological work.

Previous soil sampling completed has defined a cobalt anomaly that has a footprint of approximately 300 X 300 metres. This anomaly is greater than 25 ppm cobalt and has not been explained or followed up with groundwork. Other stream sediment samples in the area have indicated copper and cobalt anomalies.

The Company has posted the compilation report completed by Beak Consultants for TGER Pty. Ltd. which illustrates the extensions of the Tisova mineralized trend onto the German concession and potential strike length potential of mineralization.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

For additional information please contact:

21C Metals Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4455

Investors are cautioned that the estimates do not mean or imply that economic deposits exist on the Property. Other than as provided for in this press release, the Company has not undertaken any independent investigation of the estimates or other information contained in this press release nor has it independently analyzed the results of the previous exploration work in order to verify the accuracy of the information. The Company believes that the information contained in this press release are relevant to continuing exploration on the Property because they identify significant mineralization that will be the target of the Company’s exploration program.

Source: 21C Metals Inc.

Canadian Palladium is an exploration company focused on the acquisition and development of deposits of production grade metal which are critical components to current and future vehicle technology. Palladium is necessary for internal combustion engines (specifically catalytic converters) and cobalt is necessary for electric vehicle batteries.

MANAGEMENT:

Wayne Tisdale

President & CEO

Mr. Tisdale has 40 years of experience in investing, financing and consulting to private and public companies in the areas of mining, oil and gas, and agriculture. He runs his own bank and sits on the board of a number of private and public companies. Over his career, Mr. Tisdale has raised over $2bn of both equity and debt financing and has been instrumental in founding several highly successful companies, including Rainy River Resources (purchased by Newgold) and Ryland Oil Corporation (purchased by Crescent Point). Most recently, Mr. Tisdale was integral to the successful sale of US Cobalt to First Cobalt Corporation, creating a post-transaction cobalt company valued at almost $400 million.

Michelle Gahagan

Director

Ms. Gahagan has been a director of Canadian Palladium (formerly 21C Metals). Prior to her involvement in banking, Ms. Gahagan graduated from Queens University Law School and practiced corporate law for 20 years. Ms. Gahagan has extensive experience advising companies with respect to international tax-driven structures, mergers and acquisitions. Ms. Gahagan has successfully completed the Investment Management Certificate course offered by the Financial Conduct Authority (UK). Most recently, Ms. Gahagan was integral to the successful sale of US Cobalt to First Cobalt Corporation, creating a post-transaction cobalt company valued at almost $400 million.

Kelsey Chin

Chief Financial Officer & Corporate Secretary

Ms. Chin, a Chartered Professional Accountant, has over 15 years of experience in audit, finance and accounting within the mining, exploration and technology industries. She has served as director and executive officer for several publicly traded companies where she was responsible for all aspects of financial services, financial reporting, corporate governance, and has led numerous financings, mergers and acquisitions to successful completion.

PROJECTS:

EAST BULL PALLADIUM

>> February, 2019, Canadian Palladium acquires the 992 hectare East Bull property in Gerow Township, Ontario, Canada

>> The property benefits from drilling, surface trenching and some geophysics which have identified significant precious and base metal mineralization in a number of zones

>> Analysis and testing of the historical exploration has resulted in a 43-101 compliant resources estimate of 11.1m tonnes of ore at a grade of 1.46g/t PdEq for a total of 523,000 ounces of Palladium

>> The independent analysis of the updated 43-101 also highlighted the potential significant upside potential for the resource estimate after further exploration

TISOVA COPPER/COBALT PROJECT, TISOVA, CZECH REPUBLIC/GERMAN BORDER

The Tisova project is located on the Czech/German border hosted by the Kraslice Sequence, a Cambrian-age continental rift of sediments and volcanics. The Tisova VMS system has been tentatively identified as existing over 1.9 km down dip and 2.0 km along strike. Within the Kraslice Sequence, discrete copper/cobalt bearing VMS horizons appear to occur within a 100m thick assemblage termed the Tisova Horizon. Canadian Palladium’s geologists, working with recognized world experts in VMS deposits, have developed a preliminary exploration signature for copper/cobalt on the property. It is currently thought that there maybe be as much as a prospective 30 km belt.

There is a long history of mining in the area, making the logistics for exploration straightforward. Similarly, the regulatory environment has a long established regime, allowing for certainty in this regard.

SOURCE: http://canadianpalladium.com/