OilPrice.com's Latest Intelligence Report and News

Commentary - December 18, 2018

How To Profit From The Death Of Las Vegas

London –

January 14, 2019 -

OilPrice.com

Market Commentary:

Earlier this year, a little-known U.S. Supreme Court decision ripped open the

door to a potential multi-billion dollar market. Only, it’s not what you think.

I’m not talking about legal cannabis.

I’m talking about America’s other favorite vice: gambling.

According to Forbes, illegal betting on NFL and college football will hit $93

billion in 2018. Global Market Advisors estimate illicit sports betting is a

$150 billion industry.

NBA commissioner Adam Silver has written that some even estimate it at

$400 billion per year.

For decades this was a massive black market. But after a landmark ruling in the

nation’s highest court, the whole industry is now poised for rapid legalization.

A rush for the U.S. market is kicking off. And Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) is positioned to seize a chunk of the online gambling spoils.

America’s Multi Billion Dollar Gambling Revolution

On May 14th the U.S. Supreme Court ruled in favor of New Jersey in a 6-3

decision - striking down the federal law that banned sports betting in most

states.

The decision - Murphy v. National Collegiate Athletic Association - grants the

50 state legislatures the power to license and regulate sports betting.

Now - if California or New York or any other state want to legalize wagering on

the NFL or major league baseball - they can do it without any interference from

Uncle Sam.

This is a potential $400 billion market, and it’s now open for business.

On news of the decision, shares of several gaming companies moved higher

including Caesars Entertainment, up 6 percent and Penn National Gaming, up

4 percent.

And, while many investors are focusing on Blue Chip casino names - an

opportunity may be in stocks like Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF).

To dominate this new industry, you need three things:

#1 - A veteran operating team with experience in the industry.

#2 - Proven technology with a tested back office platform.

And…

#3 - Media assets that can drive massive customer growth.

Bragg has all three - and they could soon join the likes of Las Vegas Sands (LVS),

Wynn Resorts (WYNN) and Caesar’s Entertainment (CZR) in the online gaming

industry.

Veteran Gaming Industry Operators

The online gambling industry is incredibly lucrative. Oristep Consulting

estimates the market will reach

$46.7 billion in 2018, and $89 billion by 2025.

But it’s no game for amateurs. It’s highly regulated. There are major issues

with cyber security. Marketing channels are often limited. Barriers to entry are

high.

That’s how Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) sets itself apart.

The company boasts a gaming industry dream team.

CEO Dominic Mansour has nearly 20 years’ experience in the gaming and lottery

industry. He operated Full Tilt poker - the 2nd largest poker site in the world.

This was an enterprise with over $450 million in annual revenue.

He was also CEO at the UK based Health Lottery, and built bingos.com from

scratch, before selling it to NetPlay TV Plc. where he became CEO and a board

member.

CFO Akshay Kumar was previously CFO at NetPlay. Prior to this he was Financial

Controller at Sporting Index, the sports spread betting specialist.

Matevz Mazij is the Managing Director of Oryx - a key Bragg Gaming division.

He founded the company in 2010, after spending 8 years as one of the IT minds

behind multiple online and land-based gaming companies around the world.

This “dream team” has come together with a single objective:

They intend to compete across the online gambling industry’s full spectrum of

B2B and B2C verticals - first in Europe and ultimately in the United States.

To do that they’ve acquired two foundational assets.

A B2B Online Gambling Powerhouse…

...With Positive Cash Flow Today

The first pillar of the Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) opportunity is Oryx Gaming - a turnkey B2B gaming solution

provider they acquired in 2018.

It’s critical to the company’s plans for two reasons:

#1 - Infrastructure

And…

#2 - Cashflow

Let’s talk about what Oryx actually does.

It offers European gaming operators access to a diverse portfolio of proprietary

and 3rd

party Sportsbook, Lottery and Casino products.

Oryx publishes over 5,000 game titles. They provide the technology, the gaming

platform, risk management, operations and back office services.

They are certified, approved and licensed in Malta, Schleswig Holstein, Spain,

Romania, Colombia, Croatia, Serbia, Gibraltar, UK and Slovenia.

Their clients range from JackpotJoy Plc to GVC Holdings - one of the world's

largest sports betting and gaming groups at a $5.49 billion market cap.

And, right now they’re very much cash flow positive.

For the six months through June, 2018 - Oryx generated $9.49 million in revenue,

with $1.98 in EBITDA. That represents 414% growth over the same period in 2017.

This gives Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) the resources and operational capability to launch their

own B2C gaming brands in both Europe and the United States.

That’s not all. They also have a marketing springboard.

A Sports Media Asset That Dominates ESPN On Facebook

Every online business needs customers. If you’re selling cereal, or microwaves

or car insurance - you have an arsenal of advertising options at your disposal.

The online gambling and lottery industries mostly don’t have that luxury.

Since 2003 when U.S. regulators began cracking down on gambling advertisements,

most ad platforms highly restrict, or even prohibit them outright.

Facebook requires written permission in advance for any real money gaming ad.

This isn’t just an American regulatory issue. In 2007, the

U.K. banned over 1,000 gambling sites from advertising online, in print, on

the radio or on television.

That’s why Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) which was then known as Breaking Data, in 2017 acquired

GiveMeSport - a next generation sports media asset.

With 26 million followers, they are the largest sports publisher on Facebook.

ESPN is in second place with just 18 million followers - or over 44% less.

On the broader Internet, GiveMeSport is the #9 sports website on Earth.

Right now, the only monetization plan for GMS is paid advertising. Their ad

revenue growth is sitting at 83% year over year. But that’s merely the

short-term plan for the site.

The company plans to leverage the free traffic from GiveMeSport to grow other

gaming assets, initially in the UK, and then in the United States as the market

matures.

The Next World Class Gaming Company?

According to Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) CEO Dominic Mansour “the acquisition of Oryx is the first step on

the road to the creation of a new global gaming group.”

“We plan to follow this with other acquisitions in the gaming sector as we

position Bragg Gaming Group as a next generation gaming company.”

First, they intend to launch the GiveMeBet gambling platform.

This new website will start with sports betting before expanding into the other

areas including casino games, e-sports, poker and lottery products.

Oryx will provide the technology platform and software to run the service. Bragg

Gaming has an agreement with Argyll, which holds a UK betting license to operate

the site.

They’ll leverage the massive audience from their GiveMeSport website to drive

adoption and growth. This isn’t an untried model - it’s been done before.

Sky Bet was built by leveraging the Sky Sports media assets. In 2018, CVC and

Sky agreed to sell Sky Betting & Gaming to The Stars Group for

£3.4 billion.

And, don’t forget - the GiveMeSport brand has more than double the Facebook

audience of Sky Sports. The growth potential for Bragg is significant.

Initially they’ll be targeting the £4.6BN U.K. sports betting market.

As legalization unfolds in the United States, the company intends to grow and

acquire assets across the full spectrum of gaming verticals in multiple

jurisdictions.

Why You Need To Pay Attention

The May 14th U.S. Supreme Court decision to overturn PASPA, in favor of New

Jersey, was a watershed moment for online sports gambling in the United States.

Seven states — Connecticut, Delaware, Pennsylvania, Iowa, New York, Mississippi

and West Virginia — have laws prepared to make sports betting legal.

Thirteen other states have planned or proposed similar legislation. And, sports

betting isn’t the only gaming vertical affected by this monumental decision.

The New York State legislature is working on a bill to legalize online poker.

California - the most populous state in the union - is also

exploring poker legalization.

This is a massive potential opportunity for Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF)

They boast an incredibly experienced team of industry veterans. With Oryx, they

have both the infrastructure and revenue to pursue an ambitious roadmap.

Thanks to GiveMeSport’s over 30 million unique visitors – they have a media

springboard to launch B2C platforms like GiveMeBet in Europe and the U.S.

If you aren’t following Bragg Gaming Group (TSX.V:BRAG.V;

OTC:BKDCF) yet - you need to start.

By. Ian Jenkins

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING.

PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENTS. Statements in this communication which are not

purely historical are forward-looking statements and include statements

regarding beliefs, plans, intent, predictions or other statements of future

tense. Forward looking statements in this article include that the gaming

industry continues to grow; that a bigger investment opportunity than casinos

may be in growth stocks like BRAGG; that GiveMeSport’s

new website will start with sports betting before expanding into the other areas

including casino games, e-sports, poker and lottery products;

that BRAGG Systems may have a system that would be accepted by gamers; that it

can leverage the Give Me Sport fan base into sports betting through BRAGG’s

platform to drive adoption and growth; that BRAGG can protects its intellectual

property; the size of the potential sports gaming market; that Oryx gives it the

gaming platform to break into the online sports gaming and betting market: that

more states in the US will legalize sports gaming; and that BRAGG’s revenues

will continue to increase; and that

the company intends to grow and acquire assets across the full spectrum of

gaming verticals in multiple jurisdictions.

Forward looking statements involve known and unknown risks and uncertainties

which may not prove to be accurate. Actual results and outcomes may differ

materially from what is expressed or forecasted in these forward-looking

statements. Matters that may affect the outcome of these forward looking

statements include that markets may not materialize as expected; gaming may not

turn out to have as large a market as thought or be as lucrative as thought as a

result of competition or other factors; fans who like sport may not be converted

to online sports gamblers; BRAGG may not be able to offer a competitive product

or scale up as thought because of potential inferior online product, lack of

capital, lack of facilities, regulatory compliance requirements or lack of

suitable employees or contacts; BRAGG’s intellectual property rights

applications may not be granted and even if granted, may not adequately protect

BRAGG’ intellectual property rights; and other risks affecting BRAGG in

particular and the gaming industry generally. The forward-looking statements in

this document are made as of the date hereof and the Company disclaims any

intent or obligation to update such forward-looking statements except as

required by applicable securities laws.

Risk factors for the online sports gaming industry in general which also affect

BRAGG including without limitation the following: Competitors may offer better

online gaming products luring away BRAGG’s customers; Technology changes rapidly

in the business and if BRAGG fails to anticipate or successfully implement new

technologies or adopt new business strategies, technologies or methods, the

quality, timeliness and competitiveness of its products and services may suffer;

BRAGG may experience security breaches and cyber threats; regulators may impose

significant hurdles to online gaming companies; BRAGG’s business could be

adversely affected if consumer protection, data privacy and security practices

are not adequate, or perceived as being inadequate, to prevent data breaches, or

by the application of consumer protection and data privacy laws generally; The

products or services BRAGG distributes through its platform may contain defects,

which could adversely affect BRAGG’ reputation.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a

recommendation to buy or sell securities. Safehaven.com, Leacap Ltd, and their

owners, managers, employees, and assigns (collectively “the Company”) has been

paid by the profiled company or a third party to disseminate this communication.

In this case the Company has been paid by BRAGG seventy thousand US dollars for

this article and certain banner ads.

This compensation is a major conflict with our ability to be unbiased, more

specifically:

This communication is for entertainment purposes only. Never invest purely based

on our communication. Gains mentioned in our newsletter and on our website may

be based on end-of- day or intraday data. We have been compensated by BRAGG to

conduct investor awareness advertising and marketing for BRAGG. Therefore, this

communication should be viewed as a commercial advertisement only. We have not

investigated the background of the company. The third party, profiled company,

or their affiliates may liquidate shares of the profiled company at or near the

time you receive this communication, which has the potential to hurt share

prices. Frequently companies profiled in our alerts experience a large increase

in volume and share price during the course of investor awareness marketing,

which often end as soon as the investor awareness marketing ceases. The investor

awareness marketing may be as brief as one day, after which a large decrease in

volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information

on our site or in our newsletters. The information in our communications and on

our website is believed to be accurate and correct, but has not been

independently verified and is not guaranteed to be correct. The information is

collected from public and non-public sources but is not researched or verified

in any way whatsoever to ensure the information is correct.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares and/or stock options of

this featured company and therefore has an additional incentive to see the

featured company’s stock perform well. The owner of Safehaven.com will not

notify the market when it decides to buy or sell shares of this issuer in the

market. The owner of Safehaven.com will be buying and selling shares of the

featured company for its own profit. This is why we stress that you conduct

extensive due diligence as well as seek the advice of your financial advisor or

a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any

governing body in any jurisdiction to give investing advice or provide

investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a

licensed investment professional before making an investment. This communication

should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree

to the terms of this disclaimer, including, but not limited to: releasing The

Company, its affiliates, assigns and successors from any and all liability,

damages, and injury from the information contained in this communication. You

further warrant that you are solely responsible for any financial outcome that

may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards

exists, by investing, you are putting yourself at risk. You must be aware of the

risks and be willing to accept them in order to invest in any type of security.

Don't trade with money you can't afford to lose. This is neither a solicitation

nor an offer to Buy/Sell securities.

DISCLAIMER: Safehaven.com is Source of all content listed above. FN Media

Group, LLC (FNM), is a third party publisher and news dissemination service

provider, which disseminates electronic information through multiple online

media channels. FNM is NOT affiliated in any manner with Safehaven.com or any

company mentioned herein. The commentary, views and opinions expressed in this

release by Safehaven.com are solely those of Safehaven.com and are not shared by

and do not reflect in any manner the views or opinions of FNM. FNM is not

liable for any investment decisions by its readers or subscribers. FNM and its

affiliated companies are a news dissemination and financial marketing solutions

provider and are NOT a registered broker/dealer/analyst/adviser, holds no

investment licenses and may NOT sell, offer to sell or offer to buy any

security. FNM was not compensated by any public company mentioned herein to

disseminate this press release.

FNM HOLDS NO SHARES OF ANY COMPANY NAMED

IN THIS RELEASE.

This release contains "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. "Forward-looking

statements" describe future expectations, plans, results, or strategies and are

generally preceded by words such as "may", "future", "plan" or "planned", "will"

or "should", "expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude of risks and

uncertainties that could cause future circumstances, events, or results to

differ materially from those projected in the forward-looking statements,

including the risks that actual results may differ materially from those

projected in the forward-looking statements as a result of various factors, and

other risks identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange Commission.

You should consider these factors in evaluating the forward-looking statements

included herein, and not place undue reliance on such statements. The

forward-looking statements in this release are made as of the date hereof and

FNM undertakes no obligation to update such statements.

NEWS SOURCE: Safehaven.com

How A NASA

Scientist Could Trigger The Next Cannabis Boom

London –

December 18, 2018 -

OilPrice.com

Market Commentary:

Marijuana spent this year finding its feet. It may

spend next year surfing a big wave of profits.

Marijuana 1.0 was all about

the legalization drive, the dumping of billions of dollars of cash into the

industry and mouthwatering, legitimizing mergers and consolidations—but it was a

jockeying exercise in capacity expansion.

Marijuana 2.0 could be just

as big a deal—it’s about the technological tweaks that will actually make this

industry profitable.

It involves Big Data, AI,

automation and a host of other tech tweaks that will increase profitability and

open up vast new markets in key verticals. That includes everything from

recreational use and OTC pain and sleep relief to pharmaceuticals and beauty/nutraceuticals.

Wall Street’s top marijuana

expert has predicted explosive growth for the industry

eventually reaching $500 billion.

Only the most efficient and

competitive cannabis players will thrive under the coming Big Data and AI

revolution.

And one little-known company

has already developed an efficient, high-quality, low-cost automated mass

production operation.

The little-known company is

the Wayland Group (WAYL.CN,

OTC:MRRCF), and it’s positioning itself to be the “Vertical

Integrator of Cannabis”.

How?

Just like major oil companies

such as ExxonMobil or Royal Dutch Shell used their superior

Big Data capabilities to streamline their

supply chain and muscle their way to the top of the oil distribution chain, this

company is positioning itself to become the “Vertical Integrator of Cannabis” by

leveraging the first large-scale integration and automation drive in the medical

cannabis industry

Their operations require just

10 percent of the staff of a traditional operation

And for now, it remains

“little-known” because just as early investors failed to understand that Amazon

was a technology company first and a retail operation second … the same thing

could unfold in the cannabis sector.

Everything is about the

tech—and Marijuana 2.0 will prove that.

The easy money in the weed

industry has already been made. The real money comes in the next wave of profits

from companies that are able to navigate the technological and efficiency

cul-de-sacs that plague the industry…

Wayland is a “tech first”

$250-million market-cap company armed with a war chest of patented technologies

that can reshape the marijuana industry in 2019.

Here are 5 Reasons why

Wayland Inc. is slated to become successful

#1 Replacing Gut Feeling

with True Tech

Being a relatively new

industry, the cannabis space suffers from a severe shortage of credible,

evidence-based data and a major void of automation tools. As a result, most

companies have been relying on gut-feeling to run their operations - leading to

high operational inefficiencies and high costs.

Wayland Group (WAYL.CN,

OTC:MRRCF) is a medical cannabis company that’s positioning

itself as the industry’s ultra-efficient manufacturer of CBD and CBD products by

automating its upstream and downstream operations.

The company has partnered

with Rockwell Automation (NYSE:ROK) to develop a connected and scalable

platform that seamlessly connects its cultivation facilities for a consistent

and high-yield crop.

Wayland employs Rockwell’s

new exclusive agriculture platform from AI Data Grow with its hardware,

Automation FactoryTalk software and Ethernet/IP network connectivity to

streamline communication between traditional silos such as process control

functions, material handling and building automation. This connected and

scalable system provides a single, integrated platform for predictive AI,

environmental monitoring, process automation and building management.

Through this innovative

platform, the company is able to monitor and control all the variables required

for the growing of medicinal cannabis, including capturing the ideal nutrient

mix, humidity, temperature and light cycles to produce a consistently

high-quality and high-yield crop regardless of changing weather conditions. The

unified platform is highly scalable and expandable, thus allowing the company to

seamlessly replicate a bolt-on solution and facilitate rapid growth. This

improves asset utilization, shortens time-to-market and lowers costs.

The system is the industry’s

first large-scale integration in the medical cannabis industry and transfers

Rockwell’s immense expertise in life sciences to the medical cannabis industry.

Additionally, Wayland is integrating Oracle’s ERP with Rockwell and AI Data

Grow’s platform to have full visibility and control from the factory floor to

the executive suite.

Wayland’s automation drive

has earned it various industry accolades including the Good Manufacturing

Practice (GMP) rating, becoming one of only 5 EU GMP-certified producers that

can sell directly to the EU market.

That’s remarkable for a

$250-million company, with the others being the industry’s big fish: Tilray,

Canopy, Cronos and Aurora.

The big craze about the

company’s automation platform is this: It makes cannabis production energy

efficient and introduces lower labor costs. That removes two ominous bogeymen

for the sector.

Energy efficiency:

Utilizing FactoryTalk energy

metrics, Wayland is able to optimize its carbon footprint by controlling fans,

lights and other environmental specifications such as temperature, lighting,

humidity, fertigation and carbon dioxide to achieve a 90 percent-plus energy

efficiency rating (EER).

Some of its key milestones

include onsite natural gas cogeneration facilities and state-of-the-art water

filters that recycle water leading to losses of just 10,000 liters per year.

Lower labor costs:

Automation enables the

company to replace ergonomically challenging and labor-intensive jobs with

advanced operators with higher skills sets. This creates a lower headcount with

higher pay grade and thus addresses a major hurdle in agriculture agronomics.

The company has fully automated its Canadian operations, and now needs only 26

employees as opposed to 500 before the exercise. At 14 dollars an hour minimum

wage in Ontario, those savings quickly add up.

It’s a high-cost-savings bar

that other producers struggle to match.

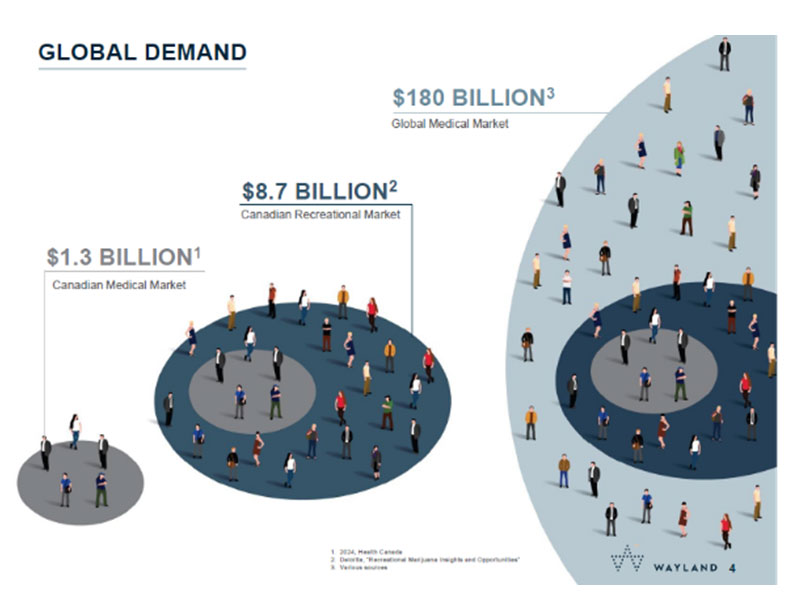

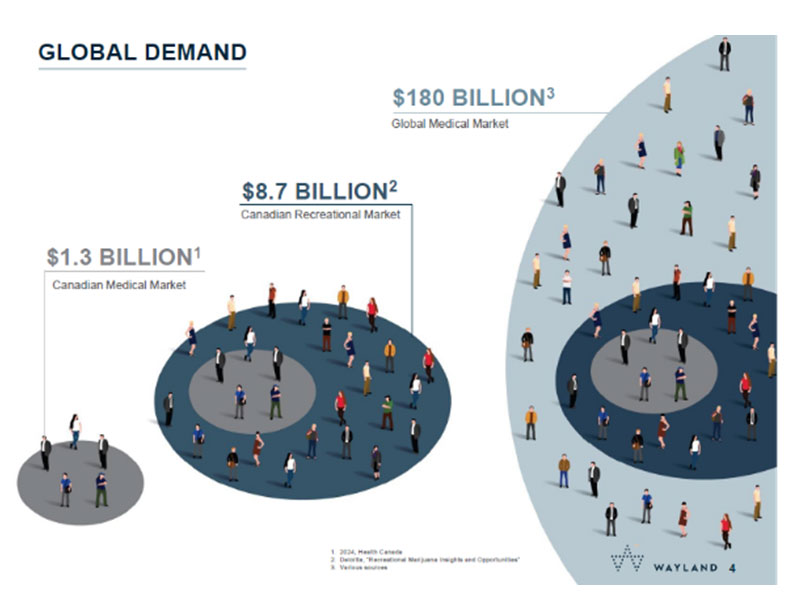

#2 Fat Profit Margins

Potential in a $180-Billion Market

Wayland (WAYL.CN,

OTC:MRRCF) is now able to leverage its innovative automation

machine using another clever trick—by only targeting growing regions and markets

that will likely provide high returns and profits.

Regions like Argentina and

Columbia where production costs are low … and markets like Switzerland, Germany

and the EU where cannabis products fetch attractive prices.

That’s because only niche

markets will deliver the kind of crazy margin goals that this company has set

for itself…

And so far, it’s working.

Wayland is now selling CBD at

CAD$16 per gram in Europe compared to prices as low as

$5.65 in Canada.

With production costs in in

Argentina and Columbia as low as 5 cents per gram for CBD, there is a massive

profit opportunity if South American CBD were to be sold in Canada.

Even the Canadian region has

become highly profitable for the company thanks to its full-on automation.

With cheap production in

Canada due to its low labor costs and automation the company is still able to

realize a very impressive gross profit in a market where pretty much everybody

else is

counting losses

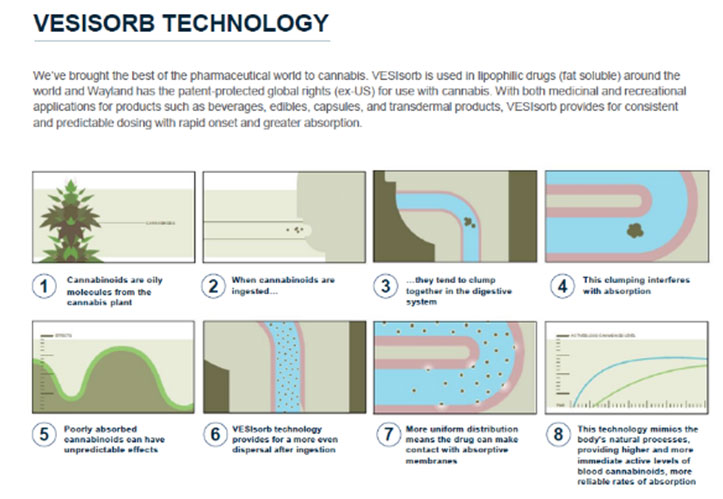

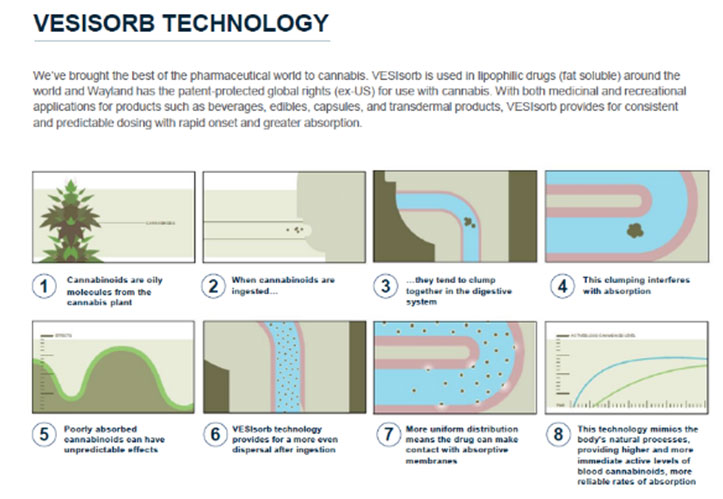

#3 Differentiated Products

Using Pharmaceutical Breakthroughs

Wayland (WAYL.CN,

OTC:MRRCF) has brought the best of the pharmaceutical world to

the marijuana industry by integrating

Vesisorb technology across its product

portfolio--thus enhancing rapid absorption and predictable dosing.

Vesisorb is a patented

product applied to fat-soluble formulations leading to as much as 622 percent

increase in bioavailability.

CBD molecules are oily in

nature and tend to clump together upon ingestion. This interferes with

absorption and can lead to unpredictable effects. Vesisorb resolves that by

improving dispersion of CBD molecules and ensure uniform absorption.

Wayland has the

patented-protected global rights (ex-U.S.) for use of Vesisorb with cannabis.

Wayland has also developed a

range of CBD brands to cater to buyers of different ages, genders, needs and

occasions. Each brand projects a unique feel and image making it easy and

intuitive for customers to make their pick in a potentially confusing industry.

Marijuana consumers no longer

fit the old stereotype of bored people simply trying to escape their crushing

suburban ennui. Wayland has created a range of high-quality products for the

sophisticated consumer, with brands like Solari--designed to provide the best

holistic and health benefits that CBD can offer, while Kiwi is perfectly

balanced to appeal to new or light users.

#4 Big Pharma and Tech

Gurus

Wayland’s (WAYL.CN,

OTC:MRRCF) advisory board is a Who’s Who of Big Pharma and

Silicon-Valley-style tech gurus—and its management team is headed by a similarly

powerful line-up of pharma-tech figures from the CEO and chairman to the CFO and

president.

The board pulls from the best

and brightest at NASA Jet Propulsion Labs (JPL) and Lockheed Martin, among

others.

All the industry bases are

covered, with a massive nod to high-tech and pharma.

Wayland President Terry Fretz

is a veteran pharmaceutical exec with two privately held generic pharma

companies under his belt that were the fastest-growing in Canada and acquired by

publicly traded multinationals.

CFO Scott Langille has over

30 years of experience in the pharmaceutical industry in both Canada and the

United States, holding executive positions at publicly traded pharma companies

including Tribute Pharmaceuticals, and Virexx Medical Corp.

The advisory board includes

everyone from Hilti Tools empire heir apparent Rudolph Hilti, Prof. Dr. Markus

Backmund MD, PhD—the chair of the German Society of Addiction Medicine, and Dr.

Horst Schiessl, on the supervisory board of Baader Bank AG, to Dr. Hans Dendl,

former chairman of AOK Health and researcher at NASA Jet Propulsion Laboratory

and Lockheed Martin Aeronautical Research.

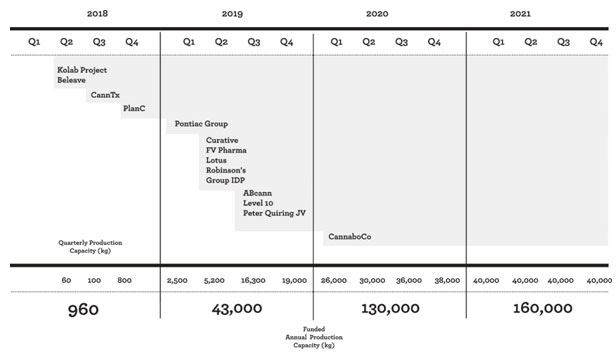

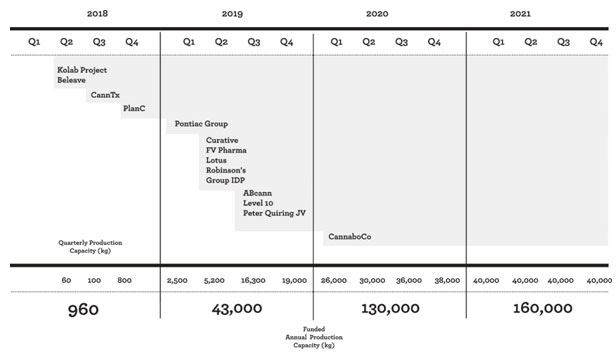

#5 An Incredible Growth

Rate

To fully capitalize on its

growing moat, Wayland (WAYL.CN,

OTC:MRRCF) plans to rapidly ramp up production in its key

markets.

From a projected 2,400 kilos

of CBD in the current year, it’s eyeing a run-rate of

95,000 kilos per annum by Q4 2019 in Canada alone.

The company expects similar

sharp ramps elsewhere— boosting dry cannabis for CBD extraction in both

Switzerland and Germany.

And, this will show where it

counts most…the bottom line.

But the best part of the

story: the company says it’s already made massive infrastructural investments to

yield free cash flow for the coming years.

Marijuana 2.0 is a tech game

above all, and this little-known company has been quietly developing the tech

this industry needs to turn hype into profit and to make good on the industry’s

desperation to expand capacity to meet demand. That’s exactly what will define

2019 for pot, and the high times will be on the back of the right tech, rolling

the right margins.

By. Ian Jenkins

**IMPORTANT! BY READING

OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Notice for Forward-Looking

Information

Certain statements in this

press release are forward-looking statements and are prospective in nature.

Forward-looking statements are not based on historical facts, but rather on

current expectations and projections about future events, and are therefore

subject to risks and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the forward-looking

statements. Such forward-looking information includes that cannabis use and

sales will grow as currently predicted; Wayland’s intended acquisition of

various foreign companies and expansion into international markets; Wayland’s

plans to bring automation and the latest technology to projects in various

locations throughout the world; that it could be granted growing licenses; that

Wayland will create a range of cannabis consumer brands, to be distributed

through their own digital platforms and retail facilities; that Wayland can

successfully integrate pharmaceutical breakthroughs into its products; that

Wayland can achieve its sales targets and gross profit margins as planned; and

that it will be able to carry out its business plans.

Readers are cautioned to not

place undue reliance on forward-looking information. Forward looking information

is subject to a number of risks and uncertainties that may cause actual results

or events to differ materially from those contemplated in the forward-looking

information, and even if such actual results or events are realized or

substantially realized, there can be no assurance that they will have the

expected consequences to, or effects on Wayland. Such risks and uncertainties

include, among other things: that a regulatory approval that may be required for

the intended acquisitions and subsequent sales are not obtained or are obtained

subject to conditions that are not anticipated; growing competition for intended

acquisitions in the cannabis industry; potential future competition in the

markets Wayland operates for sales; competitors may quickly enter the industry;

general economic conditions in the US, Canada and globally; the inability to

secure financing necessary to carry out its business plans; competition for,

among other things, capital and skilled personnel; the possibility that

government policies or laws may not permit legal cannabis sales or growth or

that favorable laws in place may change; interruption or failure of information

or other technology systems; the cannabis market may not grow as expected;

Wayland’s technology may not achieve the expected results and its

accomplishments may be limited; Wayland may not successfully develop a cannabis

consumer brand; and it may not be successful in developing a cannabis based

treatment for medical uses; even if it develops a successful treatment, it may

not be able to protect its intellectual property; its patent applications may be

rejected or successfully challenged; Wayland’s business plan also carries risk,

including its ability to comply with all applicable governmental regulations in

a highly regulated business; incubator risk investing in target companies or

projects which have limited or no operating history and are engaged in

activities currently considered illegal under US federal laws; and regulatory

risks relating to Wayland’s business, financings and strategic acquisitions.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a

recommendation to buy or sell securities. Safehaven.com, Leacap Ltd, and their

owners, managers, employees, and assigns (collectively “the Company”) has been

paid by the profiled company or a third party to disseminate this communication.

In this case the Company has been paid by Wayland fifty-eight

thousand three hundred thirty three US dollars for this article and certain

banner ads. This compensation is a major conflict with our ability to be

unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based

on our communication. Gains mentioned in our newsletter and on our website may

be based on end-of- day or intraday data. We have been compensated by Wayland to

conduct investor awareness advertising and marketing for Wayland. Therefore,

this communication should be viewed as a commercial advertisement only. We have

not investigated the background of the company. The third party, profiled

company, or their affiliates may liquidate shares of the profiled company at or

near the time you receive this communication, which has the potential to hurt

share prices. Frequently companies profiled in our alerts experience a large

increase in volume and share price during the course of investor awareness

marketing, which often end as soon as the investor awareness marketing ceases.

The investor awareness marketing may be as brief as one day, after which a large

decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information

on our site or in our newsletters. The information in our communications and on

our website is believed to be accurate and correct, but has not been

independently verified and is not guaranteed to be correct. The information is

collected from public and non-public sources but is not researched or verified

in any way whatsoever to ensure the information is correct.

SHARE OWNERSHIP. The owner of Safehaven.com will not notify the market

when it decides to buy or sell shares of this issuer in the market. The owner of

Safehaven.com will be buying and selling shares of the featured company for its

own profit. This is why we stress that you conduct extensive due diligence as

well as seek the advice of your financial advisor or a registered broker-dealer

before investing in any securities.

NOT AN INVESTMENT ADVISOR. The

Company is not registered or licensed by any governing body in any jurisdiction

to give investing advice or provide investment recommendation. ALWAYS DO YOUR

OWN RESEARCH and consult with a licensed investment professional before making

an investment. This communication should not be used as a basis for making any

investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you

agree to the terms of this disclaimer, including, but not limited to: releasing

The Company, its affiliates, assigns and successors from any and all liability,

damages, and injury from the information contained in this communication. You

further warrant that you are solely responsible for any financial outcome that

may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for

rewards exists, by investing, you are putting yourself at risk. You must be

aware of the risks and be willing to accept them in order to invest in any type

of security. Don't trade with money you can't afford to lose. This is neither a

solicitation nor an offer to Buy/Sell securities.

DISCLAIMER: Safehaven.com is Source of all content listed above. FN Media

Group, LLC (FNM), is a third party publisher and news dissemination service

provider, which disseminates electronic information through multiple online

media channels. FNM is NOT affiliated in any manner with Safehaven.com or any

company mentioned herein. The commentary, views and opinions expressed in this

release by Safehaven.com are solely those of Safehaven.com and are not shared by

and do not reflect in any manner the views or opinions of FNM. FNM is not

liable for any investment decisions by its readers or subscribers. FNM and its

affiliated companies are a news dissemination and financial marketing solutions

provider and are NOT a registered broker/dealer/analyst/adviser, holds no

investment licenses and may NOT sell, offer to sell or offer to buy any

security. FNM was not compensated by any public company mentioned herein to

disseminate this press release.

FNM HOLDS NO SHARES OF ANY COMPANY NAMED

IN THIS RELEASE.

This release contains "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. "Forward-looking

statements" describe future expectations, plans, results, or strategies and are

generally preceded by words such as "may", "future", "plan" or "planned", "will"

or "should", "expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude of risks and

uncertainties that could cause future circumstances, events, or results to

differ materially from those projected in the forward-looking statements,

including the risks that actual results may differ materially from those

projected in the forward-looking statements as a result of various factors, and

other risks identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange Commission.

You should consider these factors in evaluating the forward-looking statements

included herein, and not place undue reliance on such statements. The

forward-looking statements in this release are made as of the date hereof and

FNM undertakes no obligation to update such statements.

NEWS SOURCE: Safehaven.com

Why Is This Little-Known Element

Up Over 300%

London –

October 18, 2018 -

OilPrice.com

Market Commentary:

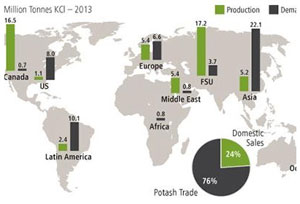

It’s the most critical economic

resource you’ve never heard of.

Element “V”.

Without this unknown commodity, you

can’t build as strong a bridge, factory or skyscraper. It’s used extensively in

planes, trains and supertankers.

It could soon form

the backbone of America’s $386 billion electrical grid.

Forget oil or gold. Wars could even

be fought over this unusual metal.

The scary part? None of it is

produced in the United States. China, Russia and South Africa control almost all

of the global production, and we’re locked in the middle of a trade war.

Now United Battery Metals Corp (CSE:UBM,

OTC:UBMCF) is one of the few companies providing some hope.

As we speak, this tiny Colorado

mineral explorer is sitting on an estimated resource of 2.7 million pounds of

proven Element “V” reserves - estimated in an independent geologist’s 43-101

technical report. And, that’s not all.

The company has nearly 800 acres of

property consisting of 39 claims, and one of the top exploration geologists in

the western United States is on board.

Here are five reasons to follow

United Battery Metals today:

-

Powering The New Energy Economy

-

“V”

Is Becoming a Critical Element In American Industry

-

The

Backing Of President Trump

-

Value In The Ground

-

An

Exploration “Ace” In The Hole

Element “V” Powers The New Energy Economy

Battery tech is

poised to transform the electricity industry. In the U.S. alone, energy

storage will grow 6x, from 120 megawatts to over 720 megawatts by 2020.

Globally, it will bring power for the first time to over a billion people by

letting them tap into micro-grids. And, while lithium is the key battery metal

of today…

Element “V” represents the true future of American battery energy.

As we speak, United Battery Metals

Corp (CSE:UBM,

OTC:UBMCF) is potentially sitting on one of the only reserves

of this critical metal anywhere in the United States.

BBC Magazine

says it will “soon be powering your neighborhood.”

Former US President Barack Obama

has touted it as the key to generating 80% of the nation's electricity from

renewable sources by the year 2035.

The little-known metal I’m talking about is vanadium.

Thanks to the VRF (vanadium

redox flow) battery - it’s set to take the energy world by storm.

These

game changing batteries are non-flammable and non-explosive. Unlike short

lived lithium ion batteries, their battery life is almost infinitely long.

Vanadium batteries already provide

complete energy storage systems for $500 per kilowatt hour, a figure that is

expected to fall below $300 per kilowatt hour in less than 2 years.

Companies like

CellCube are already building out the infrastructure with 130 installed

VRF battery facilities. Soon they’ll be in electric car charging stations

around the world.

Robert Friedland - the legendary

mining magnate – believes that “there is a revolution coming in vanadium” thanks

to this technology.

He’s building a 3-megawatt (MW),

12-megawatt-hour (MWh)

vanadium flow battery in China as part of Phase 1 of a 10-MW, 40-MWh

demonstration project.

The rise of the Element “V” powered,

global energy grid is poised to skyrocket demand for this little-known metal -

which is a huge boon for stocks like UBMCF.

How Vanadium Is Becoming A Critical Element In American Industry

Green energy is just one part of the

Element “V” story.

You see - vanadium is critical to the

production of steel. It helps make steel lighter, tougher and more efficient –

making it one of the strongest alloy metals on Earth.

You’ll find it in car frames,

pipelines, rebar, and even jet engines.

Twenty years ago, literally no

vanadium went into cars, versus around 45 percent of cars today. By 2025, it’s

estimated that 85 percent of all automobiles will include it.

For United Battery Metals Corp (CSE:UBM,

OTC:UBMCF) it’s the opportunity they’ve worked for.

And, it’s not just cars. Right now,

steel production is spiking globally.

On September 4th, 2018 - U.S. weekly

steel production capacity

utilization climbed to the highest level since 2014. The same day, China

reported new output highs.

The United States Steel Corp. is

opening new plants and modernizing others. They just

invested $750 million into their facility in Gary, Indiana.

New regulations on low quality steel

in China is

forcing producers to embrace vanadium alloys like never before. Meanwhile,

supply is horribly constrained.

It all points to one thing:

higher vanadium prices.

The price per pound is up nearly 300%

over the last three years. The world’s economic superpowers are locked in a life

or death struggle over limited supply.

With a massive property and proven

resources in safe, mining friendly Colorado – United Battery Metals

stands to help give America a boost to catch up with the competition.

President Trump’s Domestic Vanadium Push

On December 20th, 2017 - President

Trump issued an

executive order to ensure and protect reliable supplies of minerals

recognized as critical to “national security.”

The Department of Interior identified

a list of 35 so-called critical minerals.

For all of the reasons we’ve just

shared - element “V” is on the list.

Vanadium is used for America’s

buildings, roads, bridges and future green energy infrastructure. Without it, we

are way behind.

Which is a big problem because…

None of it is produced in the United States.

The big three producers are Russia,

China and South Africa. Over 70% of global production is controlled by America’s

enemies in Moscow and Beijing.

As Trump’s trade war escalates - it’s

increasingly likely China will retaliate by restricting or even banning the

export of strategic minerals.

A move like that could knee-cap the

U.S. economy in weeks.

That’s where United Battery Metals

Corp (CSE:UBM,

OTC:UBMCF) comes in.

They’re sitting on one of the only

potentially viable vanadium plays in the continental U.S.

U.S. policymakers will use the

critical minerals list to

identify which resource projects should be given fast track approval, and

assistance with government grants.

For United Battery Metals - it has

the potential to reduce red tape.

Environmental and Bureau of Land Management permitting that normally takes years

could be slashed to the bone - radically improving the project’s economics.

For the company, that would be an

incredible boon. Especially when you consider that they’re already sitting on a

substantial, proven resource.

Value in the Ground With A 43-101

United Battery Metals Corp (CSE:UBM,

OTC:UBMCF) has the Wray Mesa Project - an exploration stage

uranium-vanadium property located in Montrose County, Colorado.

Their property sits in the vanadium

rich sandstone of the Colorado Plateau.

It consists of over 39 contiguous

mining claims for a total size of about 800 acres. It could be the one of the

first vanadium mines in the United States.

Drill exploration started in the late

1940’s with the U.S. Geological Survey, then continued from the 1960’s through

the 1980’s with the private sector.

For nearly a decade, the property

hosted a producing uranium mine.

Over 739 historical drill holes have

been punched across all 39 claims - at a cost that would exceed $30 million

today. UBMCF inherited this exploration windfall.

The company now has an NI-43-101 on

the property authored by Antony Adkins in 2013. According to that report,

they’re sitting on an estimated 2.7 million pounds of vanadium and an indicated

resource of 500,000 pound of uranium.

This confirmed resource dramatically

lowers their risk.

At $18.50 per pound vanadium and

$26.20 per pound uranium - we’re talking about a potential $63,050,000 find.

Right now they have a $16 million market cap.

And, that may be the floor on this

opportunity.

With hundreds of acres left to

explore - the company expects that number to rise. They’re already initiating a

$300,000 Phase I drill campaign.

It’s to firm up their numbers near

the surface.

With hundreds of acres yet to

explore, not to mention potential upside deeper underground - the “blue sky” on

this project could be great.

They’ve Got An Exploration “Ace” In The Hole

Mineral exploration is a challenging

proposition. Luckily, United Battery Metals Corp (CSE:UBM,

OTC:UBMCF) has a secret weapon as an advisor.

Chief Exploration Advisor - Eric Saderholm

Mr. Saderholm is a professional

Geologist who previously worked as Newmont Mining’s Exploration Manager for the

entire Western United states.

He has almost 3 decades of experience

in the industry with leadership in exploration, project development, property

management and mining.

His resume includes large projects at

Bingham Canyon, Carlin, Midas, Gold Quarry, Twin Creeks, Lonetree, Mule Canyon,

Black Pine, Genesis and Yanacocha.

Over his career, he’s been integral

to geologic teams that added millions of ounces of gold to reserve bases in

Nevada, Washington and Peru.

With UBMCF his mission is to

help dramatically expand the resource at Wray Mesa and also to find additional

properties in North America with Vanadium discovery potential.

And, with the huge plot of land right

in the heart of America’s new vanadium belt - he’ll be working one of the key

exploration plays in America.

Conclusion

Urbanization is unstoppable.

Globally, 1.5 million people are added to the

urban population every week. That’s a city the size of San Antonio every 7

days.

Those new cities will require

historic quantities of steel.

High quality steel production will

spur massive demand for Element “V” - vanadium. And, when the energy grid

expands beyond Lithium…

We expect a price spike in vanadium

that could eclipse the 300% gain of the last 3 years.

Backed by the Trump administration’s

new critical metals policy, Colorado based United Battery Metals Corp (CSE:UBM,

OTC:UBMCF) is in a choice position.

They’ve got a $63 million resource,

plus nearly 800 acres of exploration upside potential with the exact geologist

you’d want to help find the mother lode.

For vanadium, the sky is the limit.

By. Charles Kennedy

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE

FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking

Statements

This article contains forward-looking information which is subject to a

variety of risks and uncertainties and other factors that could cause actual

events or results to differ from those projected in the forward-looking

statements. Forward looking statements in this article include that prices for

vanadium will retain value in future as currently expected; that UBM can

fulfill all its obligations to maintain its property; that UBM’s property can

achieve drilling and mining success for vanadium, and potentially sell 2.7M

pounds of vanadium; that the vanadium extraction process being developed will be

cost effective; that the vanadium battery process can be commercialized for

large scale production; that high grades found in samples are indicative of a

high grade deposit; that vanadium prices will increase; that high-grade vanadium

is in sufficient quantities to make drilling economic; that permits may be

easier and quicker than usual because vanadium is considered a vital element for

America; that batteries and EVs will start using large amounts of vanadium; that

vanadium system costs will be reduced quickly and dramatically; and that UBM

will be able to carry out its business plans. These forward-looking statements

are subject to a variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those projected in the

forward-looking information. Risks that could change or prevent these

statements from coming to fruition include that the Company may not be able to

finance its intended drilling programs, aspects or all of the property’s

development may not be successful, mining of the vanadium may not be cost

effective; even if mining is successful, UBM’s property may not yield 2.7M

pounds of vanadium; UBM may not raise sufficient funds to carry out its plans,

changing costs for mining and processing; permits may not be easier or quicker

than regular mining projects; increased capital costs; the timing and content of

upcoming work programs; geological interpretations and technological results

based on current data that may change with more detailed information or testing;

potential mineral recoveries assumptions based on limited test work with further

test work may not be viable; competitors may offer cheaper vanadium; more

production of vanadium could reduce its price, or the price may drop for other

reasons; technological advances to reduce vanadium system costs may not occur as

expected; alternatives could be found for vanadium in battery technology; the

availability of labour, equipment and markets for the products produced; and

despite the current expected viability of its projects, that the minerals cannot

be economically mined on its properties, or that the required permits to build

and operate the envisaged mines cannot be obtained. The forward-looking

information contained herein is given as of the date hereof and the Company

assumes no responsibility to update or revise such information to reflect new

events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This

communication is a paid advertisement and is not a recommendation to buy or sell

securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners,

managers, employees, and assigns (collectively “the Company”) has been paid by

the profiled company or a third party to disseminate this communication. In this

case the Company has been paid by UBM

fifty-nine thousand

two hundred and eighty-six US dollars for this article and certain banner ads.

This compensation is a major conflict with our ability to be

unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based

on our communication. We have been compensated by UBM to conduct investor

awareness advertising and marketing for CSE: UBM; OTC:UBMCF. Therefore, this

communication should be viewed as a commercial advertisement only. We have not

investigated the background of the company. The third party, profiled company,

or their affiliates may liquidate shares of the profiled company at or near the

time you receive this communication, which has the potential to hurt share

prices. Frequently companies profiled in our alerts experience a large increase

in volume and share price during the course of investor awareness marketing,

which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information

on our site or in our newsletters. The information in our communications and on

our website is believed to be accurate and correct but has not been

independently verified and is not guaranteed to be correct. The information is

collected from public sources, such as the profiled company’s website and press

releases, but is not researched or verified in any way whatsoever to ensure the

publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com may be buying and selling

shares of this issuer for its own profit. This is why we stress that you conduct

extensive due diligence as well as seek the advice of your financial advisor or

a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The

Company is not registered or licensed by any governing body in any jurisdiction

to give investing advice or provide investment recommendation. ALWAYS DO YOUR

OWN RESEARCH and consult with a licensed investment professional before making

an investment. This communication should not be used as a basis for making any

investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you

agree to the terms of this disclaimer, including, but not limited to: releasing

The Company, its affiliates, assigns and successors from any and all liability,

damages, and injury from the information contained in this communication. You

further warrant that you are solely responsible for any financial outcome that

may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for

rewards exists, by investing, you are putting yourself at risk. You must be

aware of the risks and be willing to accept them in order to invest in any type

of security. Don't trade with money you can't afford to lose. This is neither a

solicitation nor an offer to Buy/Sell securities. No representation is being

made that any account will or is likely to achieve profits or losses similar to

those discussed on this web site. The past performance of any trading system or

methodology is not necessarily indicative of future results

TERMS OF USE. By reading this communication you agree that you have

reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If

you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions,

please contact Oilprice.com to discontinue receiving future communications.

DISCLAIMER: OilPrice.com is Source of all content listed above. FN Media

Group, LLC (FNM), is a third party publisher and news dissemination

service provider, which disseminates electronic information through

multiple online media channels. FNM is NOT affiliated in any manner with

OilPrice.com or any company mentioned herein. The commentary, views and

opinions expressed in this release by OilPrice.com are solely those of

OilPrice.com and are not shared by and do not reflect in any manner the

views or opinions of FNM. FNM is not liable for any investment decisions

by its readers or subscribers. FNM and its affiliated companies are a

news dissemination and financial marketing solutions provider and are

NOT a registered broker/dealer/analyst/adviser, holds no investment

licenses and may NOT sell, offer to sell or offer to buy any security.

FNM was not compensated by any public company mentioned herein to

disseminate this press release.

FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E

the Securities Exchange Act of 1934, as amended and such forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. "Forward-looking

statements" describe future expectations, plans, results, or strategies

and are generally preceded by words such as "may", "future", "plan" or

"planned", "will" or "should", "expected," "anticipates", "draft",

"eventually" or "projected". You are cautioned that such statements are

subject to a multitude of risks and uncertainties that could cause

future circumstances, events, or results to differ materially from those

projected in the forward-looking statements, including the risks that

actual results may differ materially from those projected in the

forward-looking statements as a result of various factors, and other

risks identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue reliance

on such statements. The forward-looking statements in this release are

made as of the date hereof and FNM undertakes no obligation to update

such statements.

Contact Information:

Media Contact e-mail: editor@financialnewsmedia.com U.S. Phone:

+1(954)345-0611

SOURCE: Oilprice.com

The secret backdoor into a

trillion dollar company

London –

October 2, 2018 -

OilPrice.com

Market Commentary:

Mark this date down: October 17th.

That’s the day that Canada

fully legalizes recreational cannabis.

And that’s also the date that

the best kept story in the cannabis sector could be revealed.

A team that has already built

two cannabis companies to a $340 million and $5 billion valuation.

But now, they are involved

with something that could become much bigger... Scythian Biosciences (CSE:SCYB,

OTCMKTS:SCCYF)

So, what’s going on?

First, Scythian has just

closed an incredible

$280 million deal with

Aphria, the third-largest cannabis company in the world.

Aphria saw the potential in

Scythian’s “cannabis incubator” investment plans, and agreed to sell $193

million in stock to them... and today – as they close the deal – that same stock

is worth nearly $300 million.

That’s a $137 million windfall

for Scythian... a 65 percent ROI. And that’s only one deal of many.

Scythian Biosciences (CSE:SCYB,

OTCMKTS:SCCYF)

story could blow the lid off the cannabis market. It’s already one of the

biggest investment trends of 2018.

Canada is instituting full

legalization on October 17, and the Scythian story is unlikely to stay off the

radar for long when that happens.

Here are five things you need

to know about Scythian...

#1 The Crucial Time is Now

Because Canada Legalizes Recreational Cannabis on October 17th

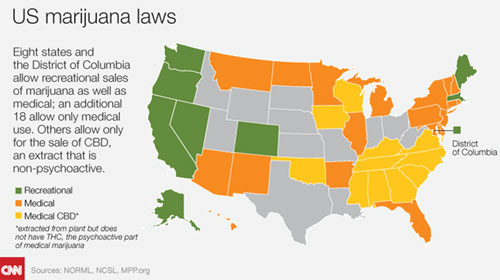

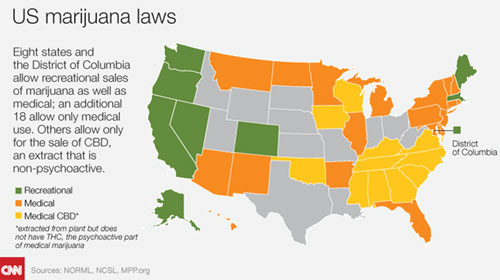

For decades, marijuana was off

the grid: an estimated $53 billion American market[i]

for an illegal substance without any kind of legitimate investment footprint.

Now, that’s changing. Canada

is on the verge of instituting full recreational legalization.

It’s all over the news, and

it’s caused a huge spike in investor interest in the cannabis sector... and it

will probably only get bigger in the run up to October 17th.

But what most people don’t

know is that the marijuana sector isn’t getting its backing from Wall Street,

which

struggles to nail down the value of the legal cannabis market while illicit

growers are still in the game.

Instead, funding is coming

from publicly traded companies acting as incubators for promising cannabis

ventures worldwide.

And Scythian Biosciences (CSE:SCYB,

OTCMKTS:SCCYF)

is the top incubator that anyone can invest in through their brokerage account.

So, Scythian stock gives

investors access to a huge potential upside normally reserved for Venture

Capital by offering the rare opportunity to buy into dozens of companies

before they hit the big time.

But mainstream investors

haven’t caught on, probably because other cannabis companies have been competing so fiercely for the cannabis spotlight. And that’s opened up a big opportunity

for investors to consider Scythian’s value in comparison to cannabis high flyers

before October 17th.

so fiercely for the cannabis spotlight. And that’s opened up a big opportunity

for investors to consider Scythian’s value in comparison to cannabis high flyers

before October 17th.

In a short span of time, the

tiny legal cannabis sector is likely to explode from near zero just a couple of

years ago to $8.7 billion in sales by 2024. Worldwide, the cannabis market could

reach $32 billion by 2022 and

$57 billion by 2027.

Access to just a tiny sliver

of that market could give Scythian a huge upside.

#2 A $57 Billion

Opportunity In Cannabis By 2027

Scythian Biosciences (CSE:SCYB,

OTCMKTS:SCCYF)

is an international incubator of cannabis assets.

That makes it unique: most pot

stocks, such as Aphria and Canopy Growth Inc., focus on cultivation, production

and marketing in one country.

Calculating an upside in those

kinds of companies is relatively straightforward, and in the case of Canopy most

of the growth

has already been realized.

With an incubator, the upside

could be enormous. One estimate has the global cannabis market

reaching $65 billion by 2023.

And the most bullish estimate

by British firm Bryan, Garnier & Co. has legal pot sales

reaching $140 billion by 2027.

Any one of Scythian’s assets

could explode on to the scene, especially at a time when cannabis laws are

changing all over the world at rapid speeds.

Scythian looks to invest in

dozens of assets at an early stage, but it only needs one asset to make it big

to realize upside from the expected $57 billion or bigger global cannabis

market.

Plus, it’s the first on the

scene when it comes to pot incubation.

Wall Street is waiting for

federal laws to loosen... so they are leery of pot stocks, and Silicon Valley

venture capital hasn’t picked up on it yet.

That leaves the field wide

open for Scythian and other pot incubators to get access to the best deals

first.

More importantly, it has

allowed early-in investors to get in on the high-upside “early” investments

normally reserved for Wall Street and Silicon Valley.

#3 Incubating Dozens of

Cannabis Companies of the Future

Scythian (CSE:SCYB,

OTCMKTS:SCCYF)

is a unique investment.

It...

·

Has an Incubator business model that

has so far resulted in a high upside...

·

Owns a highly diversified portfolio

of cannabis assets, ranging from North and South American to Western Europe...

·

Has an experienced management team

with multiple global successes

·

Has lower valuation than many

cannabis companies...

·

Is early-in to a brand new $8.7

billion market

Scythian’s “first mover”

approach is to identify ideal assets in undeveloped markets and incubate them

for maximum profitability.

In Latin America... Scythian

established relationships with “cultivation hubs”, in a market which has over

600 million people, all potential pot customers.

In North America, 90 percent

of the pot market remains illegal… and yet the market still generates more than

$9 billion a year

according to ArcView Market Research. Legalization will let Scythian tap

that market and get around behemoths like Canopy Growth Corp.

The global legal cannabis

market could be worth $57 billion in just a few years, representing exponential

growth.

And if Scythian captures just

a tiny fraction of that potential, its valuation should really please its

shareholders.

#4 Management Team:

The executive team leading

Scythian Biosciences (CSE:SCYB,

OTCMKTS:SCCYF)

has been at the forefront of the biggest success stories in cannabis.

They were involved in Aphria,

a cannabis giant that exploded into a $5 billion company. They are also some of

the leading business figures in the European cannabis industry.

But now they’re setting their

sights on the high-upside incubator business.

And Scythian’s world-class

team is poised to take advantage of a colossal new opportunity, one that could

be worth hundreds of millions of dollars.

#5 Deal Closed, October 17th

Approaching Fast

This deal between Aphria and

Scythian Biosciences just closed, so the market is still catching up to the

news.

Here’s what happened: Aphria

chose to buy into Scythian, pumping it full of fresh capital for its incubation

projects.

In July, Aphria announced

plans to buy into Scythian, hoping to acquire a number of Scythian’s Latin

America and Caribbean assets for $193 million payable mainly in Aphria stock.

Now, that Aphria stock

position is worth more: $280 million on last count, an increase of 79 percent.

Since announcing the news,

Scythian’s stock has been climbing.

But this isn’t the only deal

Scythian’s working on. They have dozens of deals in the “incubator” pipeline...

that Scythian plans to invest in, incubate and bring to maturity and better

valuations.

It’s

taking on an interest in Florida-based medical cannabis firm 3 Boys Farms

LLC, which will give it access to the Florida pot market when that state

embraces legalization. The company has announced its

new U.S. headquarters will be in Fort Lauderdale, Florida.

The acquisition is Scythian’s

first big step into the North American market, part of its plan to shift its

attention towards specific cannabis friendly zones in the United States.

The Aphria deal may be just

the beginning. Scythian has its sights set on U.S. expansion, branching out from

its start in South America to embrace North America.

The news is out there. It’s

only a matter of time before this little firm -- with some of the team behind

Red Bull -- starts to attract even more attention.

And, so far, the company has

been hard at work executing their playbook.

Expect the market to start

paying attention after recreational marijuana is sold legally in Canada on

October 17th.

When full legalization goes

through, interest in cannabis stocks could soar.

And Scythian Biosciences (CSE:SCYB,

OTCMKTS:SCCYF)

shareholders will get a piece of this

growing cannabis market... through an early mover that keeps stacking up

success upon success.

By. Ian Jenkins

[i]

https://www.huffingtonpost.com/entry/legal-cannabis-industry-growth-2016-marijuana_us_587e785be4b0cf0ae88070c0

**IMPORTANT! BY READING OUR

CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Notice for Forward-Looking Information

Certain statements in this press

release are forward-looking statements and are prospective in nature.

Forward-looking statements are not based on historical facts, but rather

on current expectations and projections about future events, and are

therefore subject to risks and uncertainties which could cause actual

results to differ materially from the future results expressed or

implied by the forward-looking statements. Such forward-looking

information includes that investor interest in the cannabis sector will

continue to grow to October 17, 2018 and beyond; that cannabis use and

sales will grow as currently predicted; Scythian Biosciences’ intended

acquisition of various foreign companies and expansion into the US

market; that the Aphria stock owned by Scythian Biosciences will retain

its current value and that Scythian Biosciences can realize a profit on

its sale; Scythian Biosciences’ plans to incubate projects in various

locations throughout the world; that it could be granted licensable

patents; that Scythian Biosciences will get an exclusive cannabis

distribution license in Florida; and that it will be able to carry out

its business plans.

Readers are cautioned to not

place undue reliance on forward-looking information. Forward looking

information is subject to a number of risks and uncertainties that may

cause actual results or events to differ materially from those

contemplated in the forward-looking information, and even if such actual

results or events are realized or substantially realized, there can be

no assurance that they will have the expected consequences to, or

effects on Scythian Biosciences. Such risks and uncertainties include,

among other things: that a regulatory approval that may be required for

the intended acquisitions and subsequent sales are not obtained or are

obtained subject to conditions that are not anticipated; growing

competition for intended acquisitions in the cannabis industry;

potential future competition in the markets Scythian Biosciences

operates for sales; competitors may quickly enter the industry; general

economic conditions in the US, Canada and globally; the inability to

secure financing necessary to carry out its business plans; competition

for, among other things, capital and skilled personnel; the possibility

that government policies or laws may not permit legal cannabis sales or

growth or that favorable laws in place may change; Scythian Biosciences

not adequately protecting its intellectual property; interruption or

failure of information technology systems; the cannabis market may not

grow as expected; Scythian Biosciences’ technology may not achieve the

expected results and its accomplishments may be limited; Florida may not

grant to Scythian Biosciences an exclusive cannabis medical license;

even if it is granted the Florida license, Scythian Biosciences’ may not

be able to profitably use it; Scythian Biosciences’ business plan also

carries risk, including its ability to comply with all applicable

governmental regulations in a highly regulated business; incubator risk

investing in target companies or projects which have limited or no

operating history and are engaged in activities currently considered

illegal under US federal laws; and regulatory risks relating to Scythian

Biosciences’ business, financings and strategic acquisitions.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a

paid advertisement and is not a recommendation to buy or sell

securities. Safehaven.com, Advanced Media Solutions Ltd, and their

owners, managers, employees, and assigns (collectively “the Company”)

has been paid by the profiled company or a third party to disseminate

this communication. In this case the Company has been paid by Scythian

Biosciences seventy thousand US dollars for this article and certain